Astute business leaders have long recognized the importance and value of building and sustaining strong, positive relationships with existing customers. Customer loyalty programs of various kinds have existed in the United States since the late 1700's.

Interest in customer loyalty grew in the 1990's when Don Peppers and Martha Rogers popularized the importance of understanding customer lifetime value in several highly-regarded books, beginning with The One to One Future. In 1996, Fred Reichheld fueled more interest when he demonstrated that creating loyal customers drives higher profits and shareholder value in The Loyalty Effect.

Over the past few years, customer experience has become one of the hottest topics in the marketing world, and numerous studies have shown that business and marketing leaders understand the strategic importance of providing outstanding experiences to both existing and potential customers.

But despite the long-standing recognition that customer loyalty is important and the current focus on providing great customer experiences, a 2015 study by Demand Metric showed that many B2B companies are still placing too little emphasis on customer retention and growth. This study also revealed that managing customer experiences is a fragmented process in most B2B companies, which may help explain why customer retention and growth receives too little attention.

The Demand Metric Study

Last November, Demand Metric published a report on customer lifecycle marketing that was based on a survey of business, marketing, and sales leaders, most of whom were affiliated with B2B companies. The Demand Metric research found that only a relatively small minority of B2B companies have fully implemented a customer lifecycle approach to marketing.

Only 19% of survey respondents said they are marketing to all stages of the customer lifecycle. Twenty-two percent of respondents said they are marketing to some stages of the lifecycle and plan to begin marketing to all stages, while another 23% said they are considering the adoption of customer lifecycle marketing.

Demand Metric also found that the average company spends about 60% of the marketing budget on new customer acquisition, but only about 30% on customer retention. Since it tends to cost more to acquire new customers than it does to keep existing ones, some disparity in spending is to be expected. However, 55% of survey respondents said that their marketing investment for the retention stage and for the advocacy stage of the customer lifecycle was minimal or none, which indicates that marketing to those lifecycle stages is a low priority.

For this survey, Demand Metric divided the customer lifecycle into five stages - awareness, consideration, purchase, retention, and advocacy - and asked survey participants to identify which of their departments has primary responsibility for managing each stage of the lifecycle. The survey results clearly show that multiple departments share responsibility for managing engagement over a customer's entire lifecycle.

An overwhelming majority of respondents agreed that marketing is primarily responsible for the awareness stage, and that sales is primarily responsible for the purchase stage. Fifty-nine percent of respondents said that marketing is also primarily responsible for the advocacy stage, and 50% gave primary responsibility to marketing for the consideration stage.

However, respondents were almost evenly split when it came to the retention stage of the customer lifecycle. Twenty-nine percent said it belonged to customer support, 26% said marketing, and 26% said sales. This finding suggests that the responsibility for customer retention may not be clearly defined in many companies, which could explain the low level of spending on customer retention marketing.

In B2B companies with "subscription" business models, the economic value of a customer is realized in installments, and customer profitability depends largely on the length of the customer relationship. In these companies, retaining customers is absolutely vital for success. In several other types of B2B companies, most customers make multiple, independent, and relatively small purchases over time. Maintaining strong relationships with existing customers is just as important for these types of companies as it is for subscription-based businesses.

The bottom line is that most B2B companies should be paying much more attention to strengthening relationships with their existing customers.

Image courtesy of Dave_S. via Flickr CC.

Sunday, February 28, 2016

Sunday, February 21, 2016

Why Your Content May Be More (or Less) Engaging Than You Think

Measuring the performance of content marketing has become a major issue for marketers over the past few years. As the popularity and use of content marketing have grown, the amount of spending on content marketing has also increased. As a result, a growing number of company leaders are requiring marketers to demonstrate the effectiveness and value of content marketing activities and programs.

Several firms that provide content marketing technologies or services have developed and published frameworks for measuring content marketing performance. Some examples are the frameworks developed by Jay Baer at Convince & Convert, Curata, and Contently.

Overall, these frameworks provide a sound approach to measuring content marketing performance. However, like most measurement systems, they include metrics that have some limitations. So, it's important for marketers to understand what each metric does (and does not) measure and therefore how each metric should (and should not) be used.

B2B content marketing effectiveness is difficult to measure for several reasons. What B2B marketers ultimately want to know is whether (and how much) their content marketing efforts are contributing to revenue generation. But in the B2B world, months or even years can separate a potential buyer's exposure to a content asset and a final buying decision. Few if any B2B marketers can afford to wait that long to find out if their content is effective.

B2B marketers also really need to know whether their content is earning and sustaining meaningful attention from potential buyers because sustained engagement is essential for winning sales. Unfortunately, however, engagement quality can be extremely difficult to measure directly.

To address these and other challenges, marketers often use what are called proxy measures. In the field of measurement science, proxy measurement refers to the act of substituting one measurement for another. The most common use of proxy measurement occurs when a measurement that is relatively inexpensive and easy to perform is substituted for a measurement that is costly, difficult, or even impossible to perform.

It's perfectly acceptable to use proxy measures, so long as the proxy has a strong correlation with the true focus of interest. However, it can be tempting to use an "easy" metric as a proxy for a "difficult" metric even when the correlation is weak or nonexistent.

To illustrate how the inappropriate use of proxy metrics can impact the measurement of content marketing effectiveness, let's consider content sharing metrics. These metrics are designed to capture how many times a piece of content is shared on social networks such as LinkedIn, Twitter, and Facebook. Content sharing contributes to content marketing success by exposing content to individuals who would not otherwise see it, and therefore it amplifies the potential reach of the content.

But some marketers also view content sharing as an indicator of - a proxy for - content engagement. The assumption is that content that is widely shared is also engaging, but that's not necessarily the case. Research by Chartbeat has shown that the correlation between social shares and content engagement is virtually nonexistent. In this research, Chartbeat examined 10,000 socially-shared articles and found that there was no relationship between the number of times an article was shared and the amount of time an average reader gave that article.

The social sharing metrics that most companies use to measure content effectiveness can also lead to inaccurate conclusions because they only capture sharing on "public" social networks. In 2014, research by RadiumOne found that 69% of all content sharing globally takes place via private digital communications tools such as e-mail and instant messaging - what is typically called "dark social" sharing.

The RadiumOne research focused on consumers, but it's likely that private content sharing is even more prevalent among business buyers. When a businessperson privately shares business-related content with his or her work colleagues, the engagement with that content is likely to be very high. Therefore, the typical content sharing metrics are even less effective for measuring content engagement in a B2B setting.

The bottom line is that measuring the true effectiveness of content marketing is difficult, and the use of proxy metrics will sometimes be necessary. But when using proxy metrics, its critical to understand what the limitations of those metrics are.

Image courtesy of Kumwenl via Flickr CC.

Several firms that provide content marketing technologies or services have developed and published frameworks for measuring content marketing performance. Some examples are the frameworks developed by Jay Baer at Convince & Convert, Curata, and Contently.

Overall, these frameworks provide a sound approach to measuring content marketing performance. However, like most measurement systems, they include metrics that have some limitations. So, it's important for marketers to understand what each metric does (and does not) measure and therefore how each metric should (and should not) be used.

B2B content marketing effectiveness is difficult to measure for several reasons. What B2B marketers ultimately want to know is whether (and how much) their content marketing efforts are contributing to revenue generation. But in the B2B world, months or even years can separate a potential buyer's exposure to a content asset and a final buying decision. Few if any B2B marketers can afford to wait that long to find out if their content is effective.

B2B marketers also really need to know whether their content is earning and sustaining meaningful attention from potential buyers because sustained engagement is essential for winning sales. Unfortunately, however, engagement quality can be extremely difficult to measure directly.

To address these and other challenges, marketers often use what are called proxy measures. In the field of measurement science, proxy measurement refers to the act of substituting one measurement for another. The most common use of proxy measurement occurs when a measurement that is relatively inexpensive and easy to perform is substituted for a measurement that is costly, difficult, or even impossible to perform.

It's perfectly acceptable to use proxy measures, so long as the proxy has a strong correlation with the true focus of interest. However, it can be tempting to use an "easy" metric as a proxy for a "difficult" metric even when the correlation is weak or nonexistent.

To illustrate how the inappropriate use of proxy metrics can impact the measurement of content marketing effectiveness, let's consider content sharing metrics. These metrics are designed to capture how many times a piece of content is shared on social networks such as LinkedIn, Twitter, and Facebook. Content sharing contributes to content marketing success by exposing content to individuals who would not otherwise see it, and therefore it amplifies the potential reach of the content.

But some marketers also view content sharing as an indicator of - a proxy for - content engagement. The assumption is that content that is widely shared is also engaging, but that's not necessarily the case. Research by Chartbeat has shown that the correlation between social shares and content engagement is virtually nonexistent. In this research, Chartbeat examined 10,000 socially-shared articles and found that there was no relationship between the number of times an article was shared and the amount of time an average reader gave that article.

The social sharing metrics that most companies use to measure content effectiveness can also lead to inaccurate conclusions because they only capture sharing on "public" social networks. In 2014, research by RadiumOne found that 69% of all content sharing globally takes place via private digital communications tools such as e-mail and instant messaging - what is typically called "dark social" sharing.

The RadiumOne research focused on consumers, but it's likely that private content sharing is even more prevalent among business buyers. When a businessperson privately shares business-related content with his or her work colleagues, the engagement with that content is likely to be very high. Therefore, the typical content sharing metrics are even less effective for measuring content engagement in a B2B setting.

The bottom line is that measuring the true effectiveness of content marketing is difficult, and the use of proxy metrics will sometimes be necessary. But when using proxy metrics, its critical to understand what the limitations of those metrics are.

Image courtesy of Kumwenl via Flickr CC.

Sunday, February 14, 2016

The Most Compelling Reason to Use Account-Based Marketing

By now, just about everyone involved in B2B marketing is aware of the hype surrounding account-based marketing (ABM). Many thought leaders argue that ABM is the "next big thing" in B2B marketing, and recent research confirms that the enthusiasm for account-based marketing is strong and growing.

- In the 2015 State of Account Based Marketing Survey by SiriusDecisions, 92% of respondents said that ABM is "extremely" or "very" important to their overall marketing efforts.

- In Demand Metric's 2015 Account-Based Marketing Adoption study, 71% of survey respondents said they are interested in adopting ABM, are testing it, or are already using it.

According to users, account-based marketing provides several important benefits. In the Demand Metric study, the four top benefits identified by ABM users were:

- Increased engagement with target accounts (83% of users)

- Better sales/marketing alignment (69%)

- Better qualified prospects (66%)

- Greater understanding of program performance (59%)

These benefits are important, but at a more basic level, the most significant potential benefit of ABM is a more productive B2B demand generation system. As Demand Metric wrote, "It [ABM] allows marketing and sales to target the accounts they value most, including prospects, current customers and partners. This precise approach to targeting helps bring the right accounts to the table, making the marketing and sales process more efficient." (Emphasis in original)

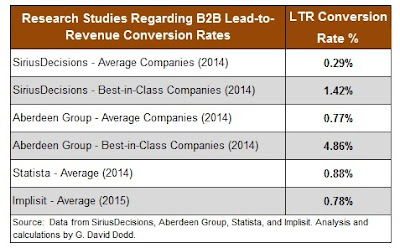

There's no doubt that demand generation productivity needs improvement. Several research studies have found that the demand generation system in many B2B companies is horribly inefficient. Specifically, these studies have shown that the overall lead-to-revenue (LTR) conversion rate in the average B2B company is extremely low. And even top-performing B2B companies don't have LTR conversion rates that are all that impressive. The following table shows the results of these research studies.

A well-designed and well-executed ABM program should improve demand generation productivity by significantly increasing a company's LTR conversion rate. In the Demand Metric research, 43% of experienced ABM users said that account-based marketing had a positive impact on all stages of the demand generation funnel.

To illustrate how ABM can impact the LTR conversion rate, take a look at the following table. This table shows the lead stage conversion rates published by SiriusDecisions for average and best-in-class B2B companies. Notice that the lowest rate in both cases is for the conversion from inquiry to marketing qualified lead (MQL).

When a company implements account-based marketing, it targets most of its marketing programs at relevant individuals who are affiliated with specified accounts. Therefore, virtually all of the responses or "inquiries" produced by those programs will, by definition, be marketing qualified leads. As a result, the inquiry to MQL conversion rate will be extremely high.

If an average B2B company increases its inquiry to MQL conversion rate to 80%, its overall LTR conversion rate will increase from 0.29% to 5.3%, even if all of the other intermediate conversion rates remain unchanged. Under the same circumstances, a best-in-class company would improve its LTR conversion rate from 1.42% to 10.2%. These increases represent an 18X improvement in demand generation productivity for an average B2B company and a 7X improvement for a best-in-class company.

For the past several years, thought leaders have argued that B2B marketers should focus more on lead quality and less on lead quantity. This change in focus is a natural consequence of using account-based marketing, and the resulting productivity improvements are impressive.

Top illustration courtesy of Richard Matthews via Flickr CC.

Top illustration courtesy of Richard Matthews via Flickr CC.

Sunday, February 7, 2016

What Really Makes B2B Buyers Loyal to Their Suppliers?

There's no longer any doubt that providing great customer experiences has become essential for competitive success. In 2014, research by Gartner found that 89% of companies expected to compete mostly on the basis of customer experience by 2016. And Walker Information recently wrote that by 2020, customer experience is expected to surpass product and pricing as the key business differentiator.

As marketers, we tend to view customer experience primarily through the lens of marketing communications, and as content marketers, we tend to think of customer experience mostly in terms of providing rich, engaging, personalized, and relevant content to our customers and prospects. It's easy to forget that customer experience is a multi-faceted phenomenon that results from all the interactions that a customer or potential customer has with a company, only some of which involve marketing communications or marketing content.

Recent research by Forrester Consulting provides important insights about what B2B buyers value most in their relationships with suppliers. For this study, Forrester surveyed 1,307 B2B buyers from around the world at organizations with at least 1,000 employees. The overall objective of the study was to explore evolving B2B buyer expectations and demands and the omnichannel practices of B2B sellers. However, my focus in this post is on a finding in the study that reveals what factors are most responsible for making B2B buyers loyal to their suppliers.

Forrester asked survey participants to rank the five most important factors (from seven possible choices) that influenced their willingness to buy again from a supplier. The table below shows the percentage of respondents who included each factor among their top five choices.

As the above table shows, the two most important drivers of loyalty were transparent prices and product details and excellent customer service and post-purchase support. What will probably surprise many marketers is that buyers ranked personalized recommendations (based on prior purchasing habits) and offering omnichannel capabilities last in importance.

When we look at the loyalty drivers that B2B buyers consider to be most important, the rankings change somewhat. The following table shows the percentage of respondents who ranked each factor first or second in importance.

In the above table, personalized recommendations ranks fourth (versus sixth in the overall ranking) and omnichannel capabilities ranks sixth (versus seventh in the overall ranking).

The findings of the Forrester study indicate that for many B2B buyers, loyalty is based on very pragmatic considerations. This doesn't mean that personalized interactions with customers and omnichannel capabilities are unimportant, but it does suggest that they should be viewed as complementary to other drivers of customer loyalty.

Top image courtesy of Flickr CC and One Way Stock.

As marketers, we tend to view customer experience primarily through the lens of marketing communications, and as content marketers, we tend to think of customer experience mostly in terms of providing rich, engaging, personalized, and relevant content to our customers and prospects. It's easy to forget that customer experience is a multi-faceted phenomenon that results from all the interactions that a customer or potential customer has with a company, only some of which involve marketing communications or marketing content.

Recent research by Forrester Consulting provides important insights about what B2B buyers value most in their relationships with suppliers. For this study, Forrester surveyed 1,307 B2B buyers from around the world at organizations with at least 1,000 employees. The overall objective of the study was to explore evolving B2B buyer expectations and demands and the omnichannel practices of B2B sellers. However, my focus in this post is on a finding in the study that reveals what factors are most responsible for making B2B buyers loyal to their suppliers.

Forrester asked survey participants to rank the five most important factors (from seven possible choices) that influenced their willingness to buy again from a supplier. The table below shows the percentage of respondents who included each factor among their top five choices.

As the above table shows, the two most important drivers of loyalty were transparent prices and product details and excellent customer service and post-purchase support. What will probably surprise many marketers is that buyers ranked personalized recommendations (based on prior purchasing habits) and offering omnichannel capabilities last in importance.

When we look at the loyalty drivers that B2B buyers consider to be most important, the rankings change somewhat. The following table shows the percentage of respondents who ranked each factor first or second in importance.

In the above table, personalized recommendations ranks fourth (versus sixth in the overall ranking) and omnichannel capabilities ranks sixth (versus seventh in the overall ranking).

The findings of the Forrester study indicate that for many B2B buyers, loyalty is based on very pragmatic considerations. This doesn't mean that personalized interactions with customers and omnichannel capabilities are unimportant, but it does suggest that they should be viewed as complementary to other drivers of customer loyalty.

Top image courtesy of Flickr CC and One Way Stock.

Subscribe to:

Posts (Atom)