Image Source: The Branded Content Project/Borrell Associates Inc.

Companies in the United States will spend $63.3 billion on content marketing this year, according to new research commissioned by The Branded Content Project. In 16 business categories, the use of content marketing is nearly ubiquitous, and it accounts for between 45% and 66% of the total marketing budget.

In mid-2020, The Branded Content Project engaged Borrell Associates Inc. to measure and analyze the economic landscape of content marketing. Sizing the Content Marketing Opportunity is based on a multi-faceted analysis of the business of content marketing. Borrell used data from its periodic surveys of small and mid-size businesses, SEC filings of public companies, and a variety of other data sources.

Content Marketing Spending

Borrell's analysis found that U.S. companies spent $64.3 billion on content marketing in 2019. Because of COVID-19, Borrell projects that content marketing spending will decline by 1.5% to $63.3 billion in 2020. This slight decline is almost entirely attributable to major spending cuts by companies that have been hit hard by the pandemic.

For example, Borrell found that companies in travel/tourism, live entertainment, sporting events, clothing and recreation have reduced spending on content marketing in 2020 by an average of 19%. Meanwhile, several other types of businesses - including financial services firms and real estate agents - have actually increased spending on content marketing this year.

The Growing Importance of Content Marketing

This analysis also found that content marketing is becoming a more important part of marketing for many companies. In Borrell's October survey of SMB's, 45% of the respondents said that content marketing had become more of a priority in 2020, and 57% said they are planning to increase content marketing in 2021.

Digital Dominates Content Marketing

It should not be surprising that most content marketing is conducted via digital channels. The following table depicts the top five media channels used for content marketing in 2020. As the table shows, digital media accounts for about two-thirds (66.3%) of all spending on content marketing this year, and collectively, these five channels account for 92.3% of all content marketing spending.

Borrell argues that digital channels dominate content marketing for two main reasons. First, digital channels can accommodate a wide variety of content formats (text, video, audio, etc.), and many types of digital content can be interactive, which makes them more engaging to potential buyers. More importantly, many digital channels enable companies to publish large volumes of content without incurring incremental advertising costs.

Business Category Rankings

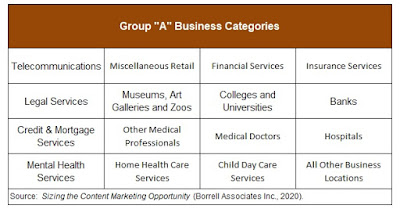

The Borrell report also provides detailed estimates for 100 distinct types of businesses. Borrell placed each type of business into one of six groups based on how likely that type of business is to engage in content marketing and what percentage of their marketing budget is devoted to content marketing. Borrell used the letters "A" through "F" to identify the six groups.

The 16 types of business organizations in group "A" (shown in the following table) are those that are most likely to be making extensive use of content marketing. In these businesses, the use of content marketing is nearly ubiquitous, and they spend between 45% and 66% of their marketing budgets on content marketing. These businesses are not necessarily the biggest spenders (on content marketing) in absolute terms, but they are devoting the highest percentage of their total marketing budgets to content marketing.

Organizations in group "B" aren't far behind. Borrell estimates that 75% to 85% of businesses in group "B" are using content marketing, and they are spending 40% to 60% of their marketing budgets on content marketing. Group "B" includes general merchandise stores (think Walmart, Target, etc.) and several types of media companies.

Two Caveats

It's important to make two points about the methodology used for this analysis. First, Borrell used an expansive definition of "content marketing." The report states:

"For this report, we considered Content Marketing to be the over-arching term that encompasses all facets of marketing - with content. This could be advertorials, native advertising, testimonials, many kinds of sponsorships, many kinds of branding, and any advertising that delivers some amount [sic] content besides a direct call to action."

This definition encompasses some marketing activities that many practitioners would not classify as "content marketing." So Borrell's spending estimates may be somewhat elevated.

On the other hand, Borrell's analysis did not include the internal costs that businesses incur to create and distribute content. Other research has shown that most companies are using internal resources to produce a significant about of marketing content. Therefore, Borrell's estimates probably understate the amount of spending actually devoted to content marketing.

Despite these caveats, Borrell's analysis makes an important contribution to our body of knowledge about content marketing.