- One-to-One ABM - "Marketer works with key account teams to develop and implement highly customized sales and marketing programs for individual accounts; typically with 5-50 strategic accounts."

- One-to-Few ABM - "Marketer works with specific sales teams to create customized campaigns for small groups or clusters of accounts with similar business attributes or imperatives . . . usually 5-15 accounts per cluster."

- One-to-Many ABM - "Marketers work with sales to target priority accounts at scale, using technology to support issue-based campaigns with personalization; typically hundreds or more named accounts."

Sunday, August 28, 2022

The Inevitable Convergence of ABM and Classic Demand Gen Marketing

Sunday, August 21, 2022

[Research Round-Up] A Look at the Attitudes and Behaviors of B2B Technology Buyers

|

| Image Source: TrustRadius |

In June, TrustRadius published the findings of its sixth annual survey of B2B technology buyers. The 2022 B2B Buying Disconnect report is based on a February 2022 survey of business professionals who were involved in the purchase of new software or hardware for their organization in the year preceding the survey.

The survey received 2,185 responses from technology buyers. Seventy-five percent of the respondents were manager level or above, and just under two-thirds (63%) were affiliated with companies having 500 or fewer employees. Sixty percent of the respondents were millennials (ages 25-40), and 29% were GenXers (ages 41-56).

The primary message of this year's survey findings is that B2B technology buyers are more committed than ever to taking control of their buying process. For the press release announcing the publication of the survey report, Vinay Bhagat, the Founder and CEO of TrustRadius, said:

"The main theme echoed throughout our 2022 report is that we are in 'The Age of the Self-Serve Buyer.' In past years, we found that millennials and generation Zs were primarily relying on self-service channels. It's a fact that we've come to expect, but now, we're finding that all generations and decision-makers are following suit. Our research found that virtually 100% of buyers want to self-serve all or part of the buying journey, a 13% increase from just last year."

It's important to emphasize that the TrustRadius research focused exclusively on the attitudes and behaviors of B2B technology buyers. Therefore, the findings of the research may not be completely applicable to all types of B2B purchases. However, most of the findings are relevant for those that involve high-consideration products or services.

Information Used to Support Buying Decisions

A primary focus of the TrustRadius research has been to identify what sources of information B2B technology buyers use to support their purchase decisions. The researchers asked survey participants what resources they consulted during their evaluation process. The following table shows how respondents answered the question in the 2022 survey and in the 2021 edition of the survey. The table also shows the change in reported usage (percentage point difference) between 2022 and 2021.

As this table shows, except for product demos and vendor blogs, the use of vendor-provided sources of information by technology buyers declined from 2021 to 2022. In contrast, the use of most "independent" sources of information increased over the same period. This finding confirms that technology buyers are relying less on vendor-provided information when researching products and services.

TrustRadius also asked survey participants what information resources they considered most impactful when making purchase decisions. A majority of survey respondents identified five information resources as impactful.

- Product demos (71% of respondents)

- Free trial/account (67%)

- Their own prior experience (67%)

- User reviews (59%)

- Consultant recommendation (52%)

Sunday, August 14, 2022

[Book Review] "The Organic Growth Playbook" - A Proven Recipe for Driving Revenue Growth

|

| Source: Emerald Publishing Limited |

Marketing industry pundits have produced an abundance of resources addressing how marketing can drive business growth. However, most of these resources focus on how to use individual marketing techniques or tactics to generate growth. There are fewer resources that address growth from a more strategic perspective.

The Organic Growth Playbook: Activate High-Yield Behaviors To Achieve Extraordinary Results - Every Time (American Marketing Association/Emerald Publishing Limited, 2020) by Bernard Jaworski and Robert Lurie provides a strategic methodology for consistently driving organic revenue growth.

The Thesis of the Book

The basic thesis of The Organic Growth Playbook is relatively simple. The authors contend that the conventional approach to marketing - which is primarily focused on differentiating a product or service in the minds of potential buyers - isn't a reliable way to drive revenue growth for most companies.

The logic of the conventional approach is that if a company positions its products or services well and effectively communicates that positioning to the right potential buyers, growth will follow. The authors disagree pointedly with the conventional wisdom. They write, ". . . great product positioning is a necessary condition for growth, but it's not sufficient in and of itself to drive growth."

Jaworski and Lurie argue that a more effective and reliable way to drive growth is to focus on shaping the activities that potential buyers perform as they move through the buying process. They contend that in every buying process, there are one or two activities that decisively shape what product or service the buyer ultimately purchases. They call these decisive activities high-yield behaviors.

High-yield behaviors often occur early in the buying process, which means that marketers often underestimate the impact they have on buying decisions.

One of the case studies in the book illustrates how important high-yield buying behaviors can be. This case study involved a company that manufactures commercial heating, ventilation and air conditioning equipment and energy management systems.

Historically, the company segmented its market by industry vertical and tailored its marketing messages and product bundles to these segments. In addition, the company's sales representatives focused primarily on responding to RFPs from larger prospects.

The company implemented the methodology described in The Organic Growth Playbook, and its analysis of the buying process for commercial HVAC equipment and energy management systems produced some interesting findings. It revealed that 52% of the potential customers that began a buying process ultimately made a purchase.

More importantly, the analysis revealed that just over 85% of the prospects that made a purchase chose a vendor they had consulted with during the early research phase of the buying process. So, prospects that ultimately made a purchase were 5X more likely to buy from a vendor they had engaged with early in their decision-making process than from a vendor that only became involved at the RFP stage.

These insights caused the company to redesign its marketing and sales efforts to focus on early engagement with potential customers, and as a result of these changes, the company's sales growth accelerated significantly in the three years after the changes were implemented.

The Playbook Process

The Organic Growth Playbook describes a five-step process for successfully driving organic revenue growth.

Map the Buying Process Waterfall - Identify all activities that potential buyers perform during the entire buying process, and determine how frequently each activity occurs. The idea is to quantify the flow of potential buyers through the process and to identify "drop off" and switch points where potential buyers exit the buying process or change buying paths. The ultimate goal of creating a waterfall map is to identify the one or two high-yield buying behaviors that have a disproportionate impact on the purchase decision.

Use Propensity-Based Segmentation - Segment potential buyers based on their propensity to engage in the high-yield buying behaviors revealed in the waterfall map. The idea is to identify the attributes that are shared by potential buyers who were most likely to engage in the high-yield behaviors and use those attributes as the basis of the market segmentation.

Identify the Drivers and Barriers of the High-Yield Behaviors - The objective of this step is to diagnose and articulate what most motivates potential buyers to perform the identified high-yield behaviors (the drivers) and what most deters them from engaging in those behaviors (the barriers)

Develop a Behavior Change Value Proposition - The fourth step in the Playbook process is to develop a value proposition that will entice potential buyers to engage in the target high-yield buying behaviors. A compelling behavior change value proposition will express the value to the potential customer of doing the high-yield behaviors compared to other possible buying behaviors, and thus increase their propensity to engage in the target behaviors.

Invest Disproportionately - The final step in the Playbook process is to make disproportionate investments in marketing programs that focus on the most attractive buyer segments and the most impactful high-yield buying behaviors. If the previous four steps of the Playbook process have been done well, such disproportionate investments will produce the best chances of achieving substantial revenue growth.

*****

The Organic Growth Playbook describes a proven methodology for driving revenue growth, but this methodology is not necessarily easy to implement. In addition, the process requires a relatively significant amount of original research, and the cost of that research won't be trivial in most cases. Nevertheless, marketers at large and midsize B2B companies should put The Organic Growth Playbook on their reading list and give serious consideration to the growth strategy it describes.

Sunday, August 7, 2022

Marketers Should Prepare for Sluggish Growth and Continued High Inflation

For the past few weeks, the hottest topic in the business/financial media has been whether the U.S. economy is headed into a recession. Every day, a parade of economists, market analysts and other pundits appear online, on TV and in print to give their view on the likelihood that a recession is on the horizon.

In addition, several major Wall Street investment firms have recently estimated that the odds of a recession occurring in the next several months have increased.

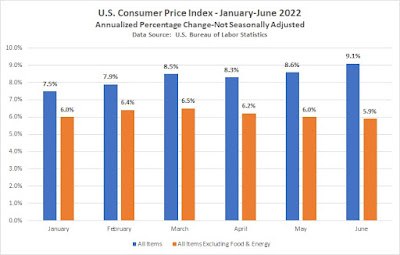

The odds of recession are increasing primarily because the U.S. Federal Reserve is tightening monetary policy in an effort to rein in historically high levels of inflation. Since the beginning of this year, the Federal Reserve Open Market Committee has raised the target federal funds interest rate 2.25%, and it has recently started reducing the size of the Federal Reserve's balance sheet (which tightens financial conditions).

The Committee has also indicated that additional interest rate increases are likely, and most Fed watchers are expecting an increase of 0.5% at the Fed's September meeting.

Marketers need to have a reasonably accurate picture of future economic conditions in order to develop sound marketing plans. As I've previously written, the health of the overall economy is one of the major factors that create the environment in which marketing plans will be executed. And while macro economic conditions affect different kinds of companies in different ways, they will impact the success of marketing efforts at most companies to some extent.

Unfortunately, the outlook for the U.S. economy over the next several months is far from clear. The uncertainty exists for several reasons, including the real-world impact of Federal Reserve's policy decisions, the continuing problems in global supply chains, and a possible energy crisis in parts of Europe this winter.

Given this high level of uncertainty, the best option for marketers is to focus on those future economic conditions that can be predicted with a reasonable degree of confidence. In my view, we can say two things about the direction of the U.S. economy over the next 6 to 12 months.

- Economic growth (as measured by real GDP) is likely to be slow even if we are able to avoid a recession.

- Inflation is likely to be persistent and remain above the Federal Reserve's target of about 2% per year, although there are some indications that we may already be past the peak of inflation.