This will be my last post for 2012, and I want to thank everyone who has spent some of his or her valuable time reading this blog. I hope that you have found the content here to be both thought-provoking and useful.

Thanks to analytics, I can see how many times each of my posts have been viewed. I thought this would be an appropriate time to share which posts have been most widely read. This ranking is based on cumulative total reads, and therefore older posts obviously have a built-in advantage.

So, in case you missed any of them, here, in order, are the four most popular posts.

Use an Importance-Performance Matrix to Get Marketing and Sales Talking - This post explains how to use an importance-performance matrix to capture the degree of agreement or disagreement between marketing and sales regarding key demand generation activities. The matrix requires marketers and salespeople to evaluate an activity along two dimensions - how important the activity is, and how well the company is performing the activity. An importance-performance matrix can reveal where significant gaps exist between marketing and sales. It won't tell you how to resolve conflicts between marketing and sales, but it will identify the issues you need to address.

Stop Depending on Your Salespeople to Generate Leads - This post explains why B2B companies should not rely primarily on their salespeople to generate new sales leads. Depending on sales reps to generate leads is a long-standing practice in many B2B companies, but changes in the attitudes and behaviors of business buyers make this practice less and less effective.

Stop Trying to Measure Marketing ROI - For the past several years, CEO's and CFO's have been demanding greater accountability from the marketing function, and they have been pressing marketers to prove the value of their activities and programs. In this environment, return on investment has become the "gold standard" for measuring marketing performance. This post explains why you can't use ROI to measure the value of every marketing activity.

It's Time to Fix the Marketing Supply Chain - Marketers are facing tremendous pressures to drive increased revenues and maximize the return produced by every dollar invested in marketing. So, it's understandable that they focus most of their attention on developing more effective marketing campaigns, creating more compelling content, and generating more sales leads. This post explains why the marketing materials supply chain represents a large, and largely untapped, source of both cost savings and revenue-enhancing improvements.

Happy New Year, everyone!

The rules of B2B marketing are constantly changing. What worked yesterday won't necessarily work today. . .or tomorrow. This blog presents information, opinion, and speculation about where B2B marketing is headed.

Saturday, December 29, 2012

Sunday, December 23, 2012

Year-End Lessons From the Past

Early in my business career, I was privileged to have a great B2B sales mentor. I met William in 1988 and interacted with him frequently until his retirement in 1995.

William sold printing presses to commercial printing companies and businesses that had internal printing departments. The company that William worked for was (and is) highly respected within the printing industry, and William was a very successful salesperson.

Early in our relationship, William told me that one important key to his success was identifying which prospects in his territory were ready to engage in a serious evaluation process that would lead to a buying decision. William also told me that, at any given time, only about 10% of the prospects in his territory would fit this description. William realized that he could use his time more effectively and close more deals if he could consistently identify which prospects were ready to begin an "active buying cycle." So, William spent a significant amount of time "taking the pulse" of his prospects.

How did he do this? Well, he spent three or four days of almost every week visiting prospects. Sometimes, he would make appointments, but frequently, he would just drop in. In most cases, the business owner or another senior manager was willing to spend thirty minutes or an hour with William, even when he showed up unexpectedly.

During these visits, William and his prospects would discuss a range of topics - what was happening in the prospect's business and in the overall printing industry and, most importantly, any issues or problems the prospect was having with his equipment. Through these visits, William could get a pretty good idea of which prospects were ready to have a meaningful conversation about buying new equipment. When he identified these "sales-ready" prospects, William would move to a more focused selling process.

I frequently write in this blog about how B2B buyers have changed and why these changes require a new approach to demand generation. So, it would be easy for me to devote this post to a discussion of why William's approach won't work in today's environment. But, as I think about what William taught me, I'm struck more by what hasn't changed.

In 2013, as in 1990, B2B companies will need a way to determine which prospects are ready to begin a serious sales conversation . . . and which ones aren't.

In 2013, as in 1990, B2B companies will need to "stay in touch" with prospects who aren't ready to begin a serious buying process . . . because some day they probably will be ready.

In 2013, successful demand generation will be more about demonstrating value and providing prospects the information they need to make a sound buying decision than about "persuading" an unprepared or reluctant prospect to buy. And, this was largely true in 1990.

The B2B marketing and sales landscape has changed, and the new rules of B2B demand generation do require different tactics and methods. I don't believe that William's tactics will work as well today as they did in the 1980s and early 1990s, but his objectives are just as valid now as they were then.

Happy Holidays, everyone!

William sold printing presses to commercial printing companies and businesses that had internal printing departments. The company that William worked for was (and is) highly respected within the printing industry, and William was a very successful salesperson.

Early in our relationship, William told me that one important key to his success was identifying which prospects in his territory were ready to engage in a serious evaluation process that would lead to a buying decision. William also told me that, at any given time, only about 10% of the prospects in his territory would fit this description. William realized that he could use his time more effectively and close more deals if he could consistently identify which prospects were ready to begin an "active buying cycle." So, William spent a significant amount of time "taking the pulse" of his prospects.

How did he do this? Well, he spent three or four days of almost every week visiting prospects. Sometimes, he would make appointments, but frequently, he would just drop in. In most cases, the business owner or another senior manager was willing to spend thirty minutes or an hour with William, even when he showed up unexpectedly.

During these visits, William and his prospects would discuss a range of topics - what was happening in the prospect's business and in the overall printing industry and, most importantly, any issues or problems the prospect was having with his equipment. Through these visits, William could get a pretty good idea of which prospects were ready to have a meaningful conversation about buying new equipment. When he identified these "sales-ready" prospects, William would move to a more focused selling process.

I frequently write in this blog about how B2B buyers have changed and why these changes require a new approach to demand generation. So, it would be easy for me to devote this post to a discussion of why William's approach won't work in today's environment. But, as I think about what William taught me, I'm struck more by what hasn't changed.

In 2013, as in 1990, B2B companies will need a way to determine which prospects are ready to begin a serious sales conversation . . . and which ones aren't.

In 2013, as in 1990, B2B companies will need to "stay in touch" with prospects who aren't ready to begin a serious buying process . . . because some day they probably will be ready.

In 2013, successful demand generation will be more about demonstrating value and providing prospects the information they need to make a sound buying decision than about "persuading" an unprepared or reluctant prospect to buy. And, this was largely true in 1990.

The B2B marketing and sales landscape has changed, and the new rules of B2B demand generation do require different tactics and methods. I don't believe that William's tactics will work as well today as they did in the 1980s and early 1990s, but his objectives are just as valid now as they were then.

Happy Holidays, everyone!

Sunday, December 16, 2012

Do Inbound Leads Really Cost Less?

Advocates of inbound marketing frequently assert that inbound sales leads cost less to acquire than outbound leads. The research usually cited to support this claim is the annual inbound marketing survey conducted by HubSpot. For example, The 2012 State of Inbound Marketing study reported that companies who spend more than 50% of their lead generation budget on inbound marketing programs experience a 61% lower cost per lead than companies who rely primarily on outbound marketing. This finding has remained very consistent from year to year in the HubSpot research.

Measuring the costs of acquiring leads through inbound and outbound marketing channels is important, but that information alone won't tell you whether inbound marketing or outbound marketing is more valuable for your business.

To get an accurate picture of how well any lead source is performing, you also need to know what quality of leads the source is producing. In this context, lead quality refers to the likelihood that a lead will actually make a purchase and become a customer. To incorporate lead quality into your evaluation, you need to use lead converstion rates to translate lead acquisition costs to the customer level.

I can illustrate how lead conversion rates impact lead costs with a simple example. The table below compares the acquisition costs of inbound vs. outbound leads at various stages of the lead-to-revenue cycle.

In this example, I'm using the lead stages defined by SiriusDecisions.

As the table shows, the cost-per-inquiry for inbound leads is significantly lower than for outbound leads. At $25.00 per inquiry vs. $41.50 per inquiry, inbound leads are about 40% cheaper than outbound leads. However, when measured on a "per new customer" basis (which is the most important number), outbound leads actually cost about 3% less than inbound leads.

I am not suggesting that outbound marketing is "better" than inbound marketing. The lead conversion rates used in my example are for illustration purposes only. In fact, research by SiriusDecisions indicates that inbound leads cost less and have higher conversion rates, on average, than outbound leads. The point here is that you can't evaluate the performance of inbound vs. outbound marketing until you measure lead acquisition costs at the customer level.

Measuring the costs of acquiring leads through inbound and outbound marketing channels is important, but that information alone won't tell you whether inbound marketing or outbound marketing is more valuable for your business.

To get an accurate picture of how well any lead source is performing, you also need to know what quality of leads the source is producing. In this context, lead quality refers to the likelihood that a lead will actually make a purchase and become a customer. To incorporate lead quality into your evaluation, you need to use lead converstion rates to translate lead acquisition costs to the customer level.

I can illustrate how lead conversion rates impact lead costs with a simple example. The table below compares the acquisition costs of inbound vs. outbound leads at various stages of the lead-to-revenue cycle.

In this example, I'm using the lead stages defined by SiriusDecisions.

- Inquiries

- Marketing qualified leads (MQLs)

- Sales accepted leads (SALs)

- Sales qualified leads (SQLs)

- New customers

As the table shows, the cost-per-inquiry for inbound leads is significantly lower than for outbound leads. At $25.00 per inquiry vs. $41.50 per inquiry, inbound leads are about 40% cheaper than outbound leads. However, when measured on a "per new customer" basis (which is the most important number), outbound leads actually cost about 3% less than inbound leads.

I am not suggesting that outbound marketing is "better" than inbound marketing. The lead conversion rates used in my example are for illustration purposes only. In fact, research by SiriusDecisions indicates that inbound leads cost less and have higher conversion rates, on average, than outbound leads. The point here is that you can't evaluate the performance of inbound vs. outbound marketing until you measure lead acquisition costs at the customer level.

Sunday, December 9, 2012

Content Marketing Basics for 2013 - The Content Audit

Starting a content marketing program from scratch can feel like an overwhelming task. Content marketing differs from traditional marketing in several fundamental ways, and it will require you to develop and field a very different portfolio of marketing assets.

In this series of posts, I'm describing three preliminary steps that will make the content development process more manageable. The first step is to identify your core customer value propositions because they define the central messages that your content resources need to communicate. The second step is to develop buyer personas because they provide the information you need to make your content resources relevant to your potential buyers.

The third preliminary step is to audit your existing inventory of content resources. A thorough content audit serves two important functions. First, it enables you to create a complete and accurate record of your existing content resources. In my experience, most marketers don't have a complete picture of what content resources they already have. Second, a content audit can be used to identify where gaps exist in your content portfolio, which helps you determine where to focus your content development efforts.

There are three basic steps involved in performing a comprehensive content audit. The first is to document basic information about each of your content assets. The second step is to associate or "map" each content resource to one or more of your identified buyer personas. In the final step, you map each content resource to one or more buying process stages on a per buyer persona basis.

To collect and organize this information, I use three spreadsheets, and I've provided example versions below.

Basic Resource Information

The spreadsheet below shows the basic information that I collect about each content asset. Most of the information required for this spreadsheet is self-explanatory, but I've included an "Instructions" row in the example.

The spreadsheet below is the tool I use to associate specific content resources with buyer personas. When mapping resources to buyer personas, the basic question you ask is whether a resource contains content that will appeal to a given buyer persona. Does the resource focus on the specific problems and challenges facing the buyer persona? Is the resource targeted for the persona's job function and industry.

You should be able to associate most content resources with at least one buyer persona, but there may be some resources that are so generic that it's just not reasonable to link them to any buyer persona. If you complete your buyer persona map and have any buyer personas with no (or very few) assigned resources, you obviously have a significant gap in your content portfolio.

Buying Stage Map

The final step in the content audit process is to associate your content resources with specific stages of the buying process. When mapping content resources to buying stages, the basic test is whether the resource contains answers for the major questions that a potential buyer will have at that stage of the buying process. The spreadsheet below is the tool I use to perform this step.

In this step, I find it easier to create a separate spreadsheet for each buyer persona. For illustration purposes, I've used a buying process that contains three stages - Discovery, Consideration, and Decision. To create a buying stage map, first select a buyer persona, then go to your buyer persona map and identify all of the content resources that you have assigned to that persona. List these resources in your buying stage map and link each resource to one or more buying stages. Repeat this process until you have a buying stage map for each of your buyer personas. If you don't have content resources for each buying stage for each buyer persona, then you've identified gaps in your content portfolio.

A content audit won't eliminate the work required to develop the content you need, but it will help you prioritize your content development projects.

Read Part 1 of the content marketing series here.

Read Part 2 of the content marketing series here.

Read Part 3 of the content marketing series here.

In this series of posts, I'm describing three preliminary steps that will make the content development process more manageable. The first step is to identify your core customer value propositions because they define the central messages that your content resources need to communicate. The second step is to develop buyer personas because they provide the information you need to make your content resources relevant to your potential buyers.

The third preliminary step is to audit your existing inventory of content resources. A thorough content audit serves two important functions. First, it enables you to create a complete and accurate record of your existing content resources. In my experience, most marketers don't have a complete picture of what content resources they already have. Second, a content audit can be used to identify where gaps exist in your content portfolio, which helps you determine where to focus your content development efforts.

There are three basic steps involved in performing a comprehensive content audit. The first is to document basic information about each of your content assets. The second step is to associate or "map" each content resource to one or more of your identified buyer personas. In the final step, you map each content resource to one or more buying process stages on a per buyer persona basis.

To collect and organize this information, I use three spreadsheets, and I've provided example versions below.

Basic Resource Information

The spreadsheet below shows the basic information that I collect about each content asset. Most of the information required for this spreadsheet is self-explanatory, but I've included an "Instructions" row in the example.

Buyer Persona Map

The spreadsheet below is the tool I use to associate specific content resources with buyer personas. When mapping resources to buyer personas, the basic question you ask is whether a resource contains content that will appeal to a given buyer persona. Does the resource focus on the specific problems and challenges facing the buyer persona? Is the resource targeted for the persona's job function and industry.

You should be able to associate most content resources with at least one buyer persona, but there may be some resources that are so generic that it's just not reasonable to link them to any buyer persona. If you complete your buyer persona map and have any buyer personas with no (or very few) assigned resources, you obviously have a significant gap in your content portfolio.

Buying Stage Map

The final step in the content audit process is to associate your content resources with specific stages of the buying process. When mapping content resources to buying stages, the basic test is whether the resource contains answers for the major questions that a potential buyer will have at that stage of the buying process. The spreadsheet below is the tool I use to perform this step.

In this step, I find it easier to create a separate spreadsheet for each buyer persona. For illustration purposes, I've used a buying process that contains three stages - Discovery, Consideration, and Decision. To create a buying stage map, first select a buyer persona, then go to your buyer persona map and identify all of the content resources that you have assigned to that persona. List these resources in your buying stage map and link each resource to one or more buying stages. Repeat this process until you have a buying stage map for each of your buyer personas. If you don't have content resources for each buying stage for each buyer persona, then you've identified gaps in your content portfolio.

A content audit won't eliminate the work required to develop the content you need, but it will help you prioritize your content development projects.

Read Part 1 of the content marketing series here.

Read Part 2 of the content marketing series here.

Read Part 3 of the content marketing series here.

Sunday, December 2, 2012

Content Marketing Basics for 2013 - Buyer Personas

Relevant content is a fundamental requirement for any effective content marketing effort. Today's business buyers are incredibly busy, and they view their time as their most precious commodity. Just as important, buyers now have easy access to a wealth of information, and they've come to believe that they can find whatever information they need whenever they need it. Under these circumstances, relevant marketing content is essential for creating and maintaining engagement with potential buyers.

To create relevant marketing content, you obviously need to know who your potential buyers are, and you must understand what makes them tick. You need to have a clear picture of the problems and issues they are facing on the job and how they are trying to deal with those problems and challenges.

The best tool for collecting and organizing information about your potential buyers is a buyer persona. A buyer persona is a detailed description of an actual type of buyer who is involved in decisions to purchase the kinds of products and services you provide. A buyer persona is, therefore, a composite description of a type of buyer, rather than a description of an individual human being. It contains demographic data about the buyer and, more importantly, it describes the buyer's business situation and motivations. Developing a persona for each of your significant buyer types will provide the information you need to create content that will resonate with those buyers.

Before beginning work on your buyer personas, you will need to develop your ideal customer profile. An ICP is a description of the types of organizations that constitute your best prospects. An ideal customer profile includes firmographic information such as industry vertical, company size, and geographic location. Much of this information will be included in the buyer personas, but I've found that it's better to develop the ICP first.

In my last post, I discussed the process for formulating your core customer value propositions. One step in that process is to identify the individuals in the prospect organization who are most affected by the issues or problems that your product or service can address. If you've gone through this process, you'll have a pretty good idea of what individuals (described by job title or job function) are part of the "buying group" for your solution. Identifying the buying group is important because it tells you what buyer personas you need to develop.

A complete B2B buyer persona will contain the following eight components:

In my next post, I'll explain how to use a content audit to determine what specific content resources you need to develop.

Read Part 1 of the content marketing series here.

Read Part 2 of the content marketing series here.

Read Part 4 of the content marketing series here.

To create relevant marketing content, you obviously need to know who your potential buyers are, and you must understand what makes them tick. You need to have a clear picture of the problems and issues they are facing on the job and how they are trying to deal with those problems and challenges.

The best tool for collecting and organizing information about your potential buyers is a buyer persona. A buyer persona is a detailed description of an actual type of buyer who is involved in decisions to purchase the kinds of products and services you provide. A buyer persona is, therefore, a composite description of a type of buyer, rather than a description of an individual human being. It contains demographic data about the buyer and, more importantly, it describes the buyer's business situation and motivations. Developing a persona for each of your significant buyer types will provide the information you need to create content that will resonate with those buyers.

Before beginning work on your buyer personas, you will need to develop your ideal customer profile. An ICP is a description of the types of organizations that constitute your best prospects. An ideal customer profile includes firmographic information such as industry vertical, company size, and geographic location. Much of this information will be included in the buyer personas, but I've found that it's better to develop the ICP first.

In my last post, I discussed the process for formulating your core customer value propositions. One step in that process is to identify the individuals in the prospect organization who are most affected by the issues or problems that your product or service can address. If you've gone through this process, you'll have a pretty good idea of what individuals (described by job title or job function) are part of the "buying group" for your solution. Identifying the buying group is important because it tells you what buyer personas you need to develop.

A complete B2B buyer persona will contain the following eight components:

- Type of business - The type of business the buyer works for. This will be drawn from your ideal customer profile.

- Job title/function - The buyer's position in the prospect organization.

- Buying role - The role the buyer plays in the purchasing decision process. Common roles include the user buyer and the economic buyer.

- Objectives/responsibilities - The major business objectives and job responsibilities of the buyer.

- Performance measures - The measures used to evaluate the buyer's job performance.

- Strategies - What the buyer does to achieve his/her objectives and fulfill his/her job responsibilities.

- Major issues/concerns - This is the heart of the buyer persona. If you can identify what issues and problems are keeping your potential buyers awake a night, you can create compelling marketing content.

- Personal attributes - These attributes include the age, gender, education level, and compensation level of your buyer. Obviously, ranges will be used for most of these attributes.

In my next post, I'll explain how to use a content audit to determine what specific content resources you need to develop.

Read Part 1 of the content marketing series here.

Read Part 2 of the content marketing series here.

Read Part 4 of the content marketing series here.

Sunday, November 25, 2012

Content Marketing Basics for 2013 - Compelling Value Propositions

If you want to implement an effective content marketing program in 2013, the place to start is with your customer value propositions. Value propositions are the cornerstone of your entire demand generation strategy, and they provide the foundation for your content marketing efforts. Most of the content resources you publish should be based on, or derived from, the core value propositions you offer.

Value propositions describe how your products and services create value for customers, and their importance cannot be overstated. The 2012 Lead Generation Benchmark Report by MarketingSherpa found that, on average, companies with clear value propositions enjoy lead generation ROI's that are 117% higher than companies without clear value propositions.

Despite their undeniable importance, many companies don't do a good job of identifying their core value propositions or creating content resources that articulate those value propositions in a compelling way. A recent survey of decision makers in B2B companies conducted by the Corporate Executive Board found that only 57% of the "unique benefits" touted by sellers were seen by potential buyers as having enough impact to create a preference for a particular seller. To put it bluntly, you simply cannot create compelling content without first identifying compelling value propositions.

Over the past two decades, I've reviewed hundreds of the "value propositions" used by clients. What I consistently find is that weak value propositions usually fall into one of three categories.

Identifying your core value propositions comes down to answering six fundamental questions about each major type or category of product or service that you offer.

I recently published a white paper that explains how to develop compelling value propositions. If you'd like a copy of this white paper, send an e-mail to ddodd(at)pointbalance(dot)com.

Read Part 1 of the content marketing series here.

Read Part 3 of the content marketing series here.

Read Part 4 of the content marketing series here.

Value propositions describe how your products and services create value for customers, and their importance cannot be overstated. The 2012 Lead Generation Benchmark Report by MarketingSherpa found that, on average, companies with clear value propositions enjoy lead generation ROI's that are 117% higher than companies without clear value propositions.

Despite their undeniable importance, many companies don't do a good job of identifying their core value propositions or creating content resources that articulate those value propositions in a compelling way. A recent survey of decision makers in B2B companies conducted by the Corporate Executive Board found that only 57% of the "unique benefits" touted by sellers were seen by potential buyers as having enough impact to create a preference for a particular seller. To put it bluntly, you simply cannot create compelling content without first identifying compelling value propositions.

Over the past two decades, I've reviewed hundreds of the "value propositions" used by clients. What I consistently find is that weak value propositions usually fall into one of three categories.

- They are too generic.

- They focus on product or service features.

- They aren't supported by credible evidence.

Identifying your core value propositions comes down to answering six fundamental questions about each major type or category of product or service that you offer.

- What are all of the significant reasons that people have for purchasing a product or service like mine? What problems or needs motivate the buying decision?

- What kinds of organizations are likely to have the problems or needs that underlie these reasons to buy?

- Who within the prospect organization is affected by each problem or need? Who has the most to gain if the problem is solved and the most to lose if it isn't?

- What specific outcomes are these people seeking?

- What features of my solution will produce these desired outcomes?

- What will the economic benefits be if these desired outcomes are achieved?

I recently published a white paper that explains how to develop compelling value propositions. If you'd like a copy of this white paper, send an e-mail to ddodd(at)pointbalance(dot)com.

Read Part 1 of the content marketing series here.

Read Part 3 of the content marketing series here.

Read Part 4 of the content marketing series here.

Sunday, November 18, 2012

Why Content Marketing Should Be a Core Part of Your 2013 Business Plan

With less than two months remaining in 2012, you've probably started planning for next year. If your marketing and sales efforts produced the results you hoped for in 2012, that's great! Congratulations on your success! Moving into 2013, you may only need to make minor adjustments to reach your revenue goals for next year.

On the other hand, if your marketing and sales efforts this year have not met your expectations, you may need to make substantial changes in your demand generation program to make 2013 a success.

If you aren't already using content marketing as a core component of your demand generation strategy, that's one change you need to make in 2013. Research by the Content Marketing Institute and MarketingProfs shows clearly that content marketing has become an essential part of B2B demand generation. According to the B2B Content Marketing: 2013 Benchmarks, Budgets, and Trends study:

The first thing you must do to create an effective content marketing program is identify what content resources you need. To some extent, of course, this determination will be based on the content distribution channels you choose to use. For example, if you decide to have a company blog, you will obviously need to create blog posts on a regular basis.

Even before you start thinking about content formats, however, you must determine what specific messages your content resources need to communicate. My next three posts will describe a proven process for identifying what content resources your company needs to implement an effective content marketing program.

In my next post, I'll explain how to identify your core customer value propositions. Your value propositions constitute the foundation for your entire content marketing program, so it's obviously critical to get them right at the beginning of your planning process. In the following post, I'll describe how to develop buyer personas. Buyer personas will help ensure that your marketing messages are relevant to potential buyers. The fourth post in this series will describe how to use a content audit to identify where gaps exist in your portfolio of content resources and where your content development efforts need to be focused.

Read Part 2 of the content marketing series here.

Read Part 3 of the content marketing series here.

Read Part 4 of the content marketing series here.

On the other hand, if your marketing and sales efforts this year have not met your expectations, you may need to make substantial changes in your demand generation program to make 2013 a success.

If you aren't already using content marketing as a core component of your demand generation strategy, that's one change you need to make in 2013. Research by the Content Marketing Institute and MarketingProfs shows clearly that content marketing has become an essential part of B2B demand generation. According to the B2B Content Marketing: 2013 Benchmarks, Budgets, and Trends study:

- 91% of B2B marketers are using content marketing in some form

- 33% of B2B marketing budgets are now allocated to content marketing, up from 26% in 2011

- 54% of B2B marketers say they will increase their content marketing spending in 2013

The first thing you must do to create an effective content marketing program is identify what content resources you need. To some extent, of course, this determination will be based on the content distribution channels you choose to use. For example, if you decide to have a company blog, you will obviously need to create blog posts on a regular basis.

Even before you start thinking about content formats, however, you must determine what specific messages your content resources need to communicate. My next three posts will describe a proven process for identifying what content resources your company needs to implement an effective content marketing program.

In my next post, I'll explain how to identify your core customer value propositions. Your value propositions constitute the foundation for your entire content marketing program, so it's obviously critical to get them right at the beginning of your planning process. In the following post, I'll describe how to develop buyer personas. Buyer personas will help ensure that your marketing messages are relevant to potential buyers. The fourth post in this series will describe how to use a content audit to identify where gaps exist in your portfolio of content resources and where your content development efforts need to be focused.

Read Part 2 of the content marketing series here.

Read Part 3 of the content marketing series here.

Read Part 4 of the content marketing series here.

Sunday, November 11, 2012

It's Time to Integrate Marketing and Sales

Marketing and sales "alignment" remains a hot topic among B2B marketing and sales professionals. Many people on "both sides of the aisle" now recognize that successfully finding and winning new customers in today's business environment requires a cohesive and coordinated effort by both marketing and sales.

A growing number of marketing and sales thought leaders are beginning to advocate more dramatic changes in the structure and character of the marketing-sales relationship and/or the techniques used to manage marketing and sales activities. Late last year, the Chartered Institute of Marketing in London published a report arguing that most companies should merge their marketing and sales functions.

Adam Needles, the author of Balancing the Demand Equation, argued in an article for DemandGen Report that marketing and sales need to be more closely aligned against a strategic lead-to-revenue demand process. Commenting on Adam's article, Eric Wittlake wrote in his B2B Digital Marketing blog, "The real implication, although Adam doesn't say it, is that sales and marketing alignment is the wrong objective. Perfectly aligning sales and marketing on either side of the fictitious wall dividing them isn't the answer. Instead, the wall needs to be torn down and sales and marketing need to be integrated through the entire customer experience."

Research firm IDC has also entered the discussion. In addition to research, IDC provides marketing and sales advisory services to technology companies and has produced operational-level scorecards for both marketing and sales for several years. Now, IDC has introduced a Customer Creation Scorecard, which IDC describes as, "Operational KPI's for the Intersection of Sales and Marketing." The new IDC scorecard contains eight key performance indicators, including the combined sales and marketing budget ratio (marketing and sales spending as a percentage of total revenues), the ratio of sales spending to marketing spending, and the marketing investment per total sales headcount.

While IDC doesn't expressly advocate that marketing and sales should be merged, these metrics strongly suggest that managers should treat marketing and sales as components of a single "customer creation" process.

Rich Vansil, IDC's Group Vice President, Executive Advisory Services, has expressed something close to this view. In an article for BtoBOnline, he wrote, "I encourage b2b marketers to think about redefining the footprint of marketing in your organization, and by extension the footprint and impact of the marketing budget. . . Think about the totality of marketing plus sales costs. . . The best opportunity for marketing and sales productivity improvement continues to be at the intersection of these two functions."

Compared to other major trends in B2B marketing and sales, such as the shift to content marketing, the growing use of inbound marketing, and the implementation of marketing automation technologies, moves to integrate marketing and sales are just barely beginning.

As I noted earlier, most of the focus today is on aligning sales and marketing, and only a few companies have addressed the more controversial issue of marketing-sales integration. This is a touchy political issue, and I don't pretend to know how it will play out. There is still a significant amount of cultural and political baggage that separates marketing and sales, and there are legitimate issues regarding the consequences (intended and unintended) of integrating marketing and sales. In addition, no single approach to marketing and sales integration will be optimum for all B2B companies. What I do know, however, is that we can no longer afford to treat marketing and sales as completely separate functional silos.

Note: For an updated view on this important topic, please take a look at Why Marketing-Sales "Alignment" Is No Longer Enough.

A growing number of marketing and sales thought leaders are beginning to advocate more dramatic changes in the structure and character of the marketing-sales relationship and/or the techniques used to manage marketing and sales activities. Late last year, the Chartered Institute of Marketing in London published a report arguing that most companies should merge their marketing and sales functions.

Adam Needles, the author of Balancing the Demand Equation, argued in an article for DemandGen Report that marketing and sales need to be more closely aligned against a strategic lead-to-revenue demand process. Commenting on Adam's article, Eric Wittlake wrote in his B2B Digital Marketing blog, "The real implication, although Adam doesn't say it, is that sales and marketing alignment is the wrong objective. Perfectly aligning sales and marketing on either side of the fictitious wall dividing them isn't the answer. Instead, the wall needs to be torn down and sales and marketing need to be integrated through the entire customer experience."

Research firm IDC has also entered the discussion. In addition to research, IDC provides marketing and sales advisory services to technology companies and has produced operational-level scorecards for both marketing and sales for several years. Now, IDC has introduced a Customer Creation Scorecard, which IDC describes as, "Operational KPI's for the Intersection of Sales and Marketing." The new IDC scorecard contains eight key performance indicators, including the combined sales and marketing budget ratio (marketing and sales spending as a percentage of total revenues), the ratio of sales spending to marketing spending, and the marketing investment per total sales headcount.

While IDC doesn't expressly advocate that marketing and sales should be merged, these metrics strongly suggest that managers should treat marketing and sales as components of a single "customer creation" process.

Rich Vansil, IDC's Group Vice President, Executive Advisory Services, has expressed something close to this view. In an article for BtoBOnline, he wrote, "I encourage b2b marketers to think about redefining the footprint of marketing in your organization, and by extension the footprint and impact of the marketing budget. . . Think about the totality of marketing plus sales costs. . . The best opportunity for marketing and sales productivity improvement continues to be at the intersection of these two functions."

Compared to other major trends in B2B marketing and sales, such as the shift to content marketing, the growing use of inbound marketing, and the implementation of marketing automation technologies, moves to integrate marketing and sales are just barely beginning.

As I noted earlier, most of the focus today is on aligning sales and marketing, and only a few companies have addressed the more controversial issue of marketing-sales integration. This is a touchy political issue, and I don't pretend to know how it will play out. There is still a significant amount of cultural and political baggage that separates marketing and sales, and there are legitimate issues regarding the consequences (intended and unintended) of integrating marketing and sales. In addition, no single approach to marketing and sales integration will be optimum for all B2B companies. What I do know, however, is that we can no longer afford to treat marketing and sales as completely separate functional silos.

Note: For an updated view on this important topic, please take a look at Why Marketing-Sales "Alignment" Is No Longer Enough.

Sunday, November 4, 2012

Why Distributed Marketing Technology May Be Relevant for Your Company

My last three posts have discussed how technology can improve the productivity of distributed marketing. By the traditional definition, distributed marketing refers to a marketing model in which both a corporate marketing department and local organizations or business units share responsibility for performing marketing activities. The stereotypical example of a distributed marketing organization is a franchise network, but distributed marketing models are also frequently found in industries like insurance, financial services, and manufacturing.

In my earlier posts, I've described how distributed marketing technologies enhance the productivity of distributed marketing operations. These technologies enable corporate marketers to maintain brand consistency, while simultaneously allowing local marketers to customize materials to fit local conditions. Just as important, these technologies simplify and automate marketing processes and make it easy for relatively inexperienced marketers to develop and execute effective marketing programs.

The main point of this post is that the benefits provided by distributed marketing technologies are not limited to companies with "classic" distributed marketing organizational structures. In fact, the same technological capabilities can also improve the marketing efforts of virtually all kinds of companies. Here's why.

Its now abundantly clear that relevance is an essential component of effective marketing. To cut through the ever-increasing clutter of marketing messages that fill the environment and create meaningful engagement with potential customers, marketing messages and materials must be relevant.

The need to make marketing more relevant is the driving force behind a growing emphasis on "localized" marketing. In a recent survey by the CMO Council, 86% of marketers said they intend to look for ways to better localize marketing content. While most marketers are committed to increasing localized marketing, it is not a simple task. The reality is, it's difficult for marketers in a central marketing department to truly understand what's needed to make marketing effective in diverse local markets.

One solution, of course, is to decentralize marketing, to place the responsibility for making marketing decisions and running marketing programs with individuals who are "closer to the customer." Decentralized marketing is not a new idea, and global enterprises have been decentralizing some marketing functions for years. However, despite the obvious benefits, many companies have been reluctant to decentralize marketing for three primary reasons.

The important point here is that the capabilities provided by distributed marketing technologies can enable any company to implement a more decentralized approach to marketing without sacrificing brand control or marketing process efficiency.

If your company can benefit from more relevant localized marketing (and virtually all companies can), you should carefully consider how "distributed marketing" technologies could improve your marketing efforts.

Read Part 1 of the series here.

Read Part 2 of the series here.

Read Part 3 of the series here.

In my earlier posts, I've described how distributed marketing technologies enhance the productivity of distributed marketing operations. These technologies enable corporate marketers to maintain brand consistency, while simultaneously allowing local marketers to customize materials to fit local conditions. Just as important, these technologies simplify and automate marketing processes and make it easy for relatively inexperienced marketers to develop and execute effective marketing programs.

The main point of this post is that the benefits provided by distributed marketing technologies are not limited to companies with "classic" distributed marketing organizational structures. In fact, the same technological capabilities can also improve the marketing efforts of virtually all kinds of companies. Here's why.

Its now abundantly clear that relevance is an essential component of effective marketing. To cut through the ever-increasing clutter of marketing messages that fill the environment and create meaningful engagement with potential customers, marketing messages and materials must be relevant.

The need to make marketing more relevant is the driving force behind a growing emphasis on "localized" marketing. In a recent survey by the CMO Council, 86% of marketers said they intend to look for ways to better localize marketing content. While most marketers are committed to increasing localized marketing, it is not a simple task. The reality is, it's difficult for marketers in a central marketing department to truly understand what's needed to make marketing effective in diverse local markets.

One solution, of course, is to decentralize marketing, to place the responsibility for making marketing decisions and running marketing programs with individuals who are "closer to the customer." Decentralized marketing is not a new idea, and global enterprises have been decentralizing some marketing functions for years. However, despite the obvious benefits, many companies have been reluctant to decentralize marketing for three primary reasons.

- Corporate marketers fear losing control of brand messaging and brand presentation.

- There is often a lack of marketing resources and expertise in branch locations or other local outlets.

- Decentralization can lead to duplicative or otherwise inefficient marketing processes.

The important point here is that the capabilities provided by distributed marketing technologies can enable any company to implement a more decentralized approach to marketing without sacrificing brand control or marketing process efficiency.

If your company can benefit from more relevant localized marketing (and virtually all companies can), you should carefully consider how "distributed marketing" technologies could improve your marketing efforts.

Read Part 1 of the series here.

Read Part 2 of the series here.

Read Part 3 of the series here.

Sunday, October 28, 2012

How to Make Local Marketing Easier

This is the third of four posts dealing with distributed marketing. So far in this series, I've explained what distributed marketing is, described the major challenges facing distributed marketers, and discussed why technology is critical to improving the productivity of distributed marketing.

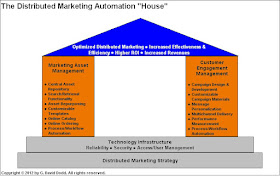

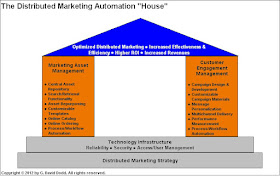

The diagram below shows that the distributed marketing automation "house" includes two core types of technological capabilities. In my last post, I discussed the marketing asset management component of distributed marketing automation. This post covers the technology tools used to streamline and automate customer engagement management activities and processes.

What CEM Technologies Do

The diagram below shows that the distributed marketing automation "house" includes two core types of technological capabilities. In my last post, I discussed the marketing asset management component of distributed marketing automation. This post covers the technology tools used to streamline and automate customer engagement management activities and processes.

One of the major challenges facing organizations that rely on distributed marketing is a lack of marketing resources and expertise at the local level. According to research by the Aberdeen Group, the lack of local marketing resources is one of the two biggest challenges for distributed marketing organizations. Because many local entities are small organizations or business units, this is compeltely understandable and probably unavoidable. One result of this lack of resources and expertise is that local partners don't market as frequently or extensively as they should to maximize revenues.

What CEM Technologies Do

The customer engagement management technologies in distributed marketing automation solutions simplify marketing processes and empower local marketers to effectively and efficiently plan, execute, and measure the results of advertising and marketing campaigns and programs.

Customer engagement technologies build on the capabilities of marketing asset management by using customizable templates that enable local marketers to easily create advertisements and other marketing campaign materials. In general, the capabilities provided by customer engagement technologies fall into three broad categories.

Campaign Planning/Management

This category typically includes tools for planning and scheduling marketing campaigns and the tasks required to develop and execute those campaigns.

Campaign Execution

In addition to using templates to create campaign materials, most distributed marketing automation solutions enable local marketers to execute e-mail marketing campaigns either directly or through a link to an e-mail service provider. For direct mail campaigns, the solution will typically enable local marketers to upload mail lists, select recipients from the corporate database, or purchase a mailing list from a third party provider.

Campaign Performance Measurement

Distributed marketing automation solutions typically include tools that enable local marketers to measure the performance of their marketing programs. Some solutions provide corporate marketers access to this performance data, and some will also enable a local marketer to see the results obtained by other local marketers from particular campaigns. This capability enables "best practices" knowledge to be shared across the distributed marketing network.

Benefits of CEM Technologies

The cutomer engagement management technologies in distributed marketing automation solutions make it easy for local marketers to create and run marketing campaigns and programs, and they will usually reduce the cost of those programs. Therefore, these technologies encourage local marketers to run marketing programs more frequently, and increased local marketing will drive higher revenues for both the local entity and the corporate brand owner.

The cutomer engagement management technologies in distributed marketing automation solutions make it easy for local marketers to create and run marketing campaigns and programs, and they will usually reduce the cost of those programs. Therefore, these technologies encourage local marketers to run marketing programs more frequently, and increased local marketing will drive higher revenues for both the local entity and the corporate brand owner.

By supporting extensive and cost-effective customization of marketing messages and materials, CEM technologies also enable local marketers to create and run more relevant and therefore more effective marketing programs.

Finally, CEM technologies enable corporate marketers to maintain control of brand messaging and brand presentation, while simultaneously allowing local marketers to develop and run programs that fit local market conditions.

Sunday, October 21, 2012

How Marketing Asset Management Improves Distributed Marketing

This is the second of four posts discussing how to improve distributed marketing operations. In my last post, I explained what distributed marketing is, and I described the major challenges facing distributed marketing organizations. I also made the point that you simply cannot maximize the productivity of distributed marketing without the right technology tools, and I introduced the model of distributed marketing automation depicted in the following illustration.

The marketing asset management component of a distributed marketing automation solution provides several financial and operational benefits. For example, MAM technologies will:

Read Part 1 of the series here.

Read Part 3 of the series here.

Read Part 4 of the series here.

As this diagram shows, a distributed marketing automation solution contains two major technology toolsets - marketing asset management (MAM) and customer engagement management.

The marketing asset management component of a distributed marketing automation solution is the primary tool for managing the marketing assets and materials used in distributed marketing activities and programs. These materials will typically include marketing collateral documents, print advertisements, promotional items, and point-of-sale materials.

What MAM Technologies Do

Marketing asset management technologies enable corporate marketers to maintain control of brand messaging and brand presentation, while simultaneously allowing local marketers to easily customize marketing materials to fit their specific needs and market conditions. MAM technologies also streamline and automate the process of procuring marketing materials.

The principal features of MAM technologies include:

- Central asset repository - A centralized repository, or library, that contains digital versions of the marketing assets used by the brand owner in distributed marketing activities and programs

- Online catalog/ordering system - A catalog of marketing materials that local marketers can access via a secure website. The MAM system will also enable local marketers to order (and, if appropriate, pay for) marketing materials.

- Customizable templates - Templates of marketing materials that identify which content elements of each item can be modified and which elements cannot be changed. For those elements that can be customized, the template will provide a set of pre-approved customization options. To customize an item, a local marketer simply selects a template and chooses the desired customization options.

The marketing asset management component of a distributed marketing automation solution provides several financial and operational benefits. For example, MAM technologies will:

- Eliminate the internal costs of processing and fulfilling requests for marketing materials

- Reduce the time required to process and fulfill requests for marketing materials

- Enable corporate marketers to maintain effective control of brand messaging and brand presentation

- Simplify and automate the process of creating customized marketing materials, thus lowering customization costs. In addition, MAM technologies expand the degree of customization that can be done, thus allowing local marketers to create more relevant and compelling marketing materials.

- Reduce the use of obsolete marketing materials

- Reduce the costs of marketing materials obsolescence

Read Part 1 of the series here.

Read Part 3 of the series here.

Read Part 4 of the series here.

Saturday, October 13, 2012

How to Make Distributed Marketing More Productive

Thousands of companies sell products and services through regional or local outlets. These outlets may be branch offices or company-owned retail stores, or they may be related but independent business organizations such as franchisees or independent agents. In many cases, the local organization or business unit shares responsibility for marketing with the corporate marketing department. When both corporate and local marketers make marketing decisions and perform marketing activities, we call this distributed marketing.

This is the first of four posts about distributed marketing. In this post, I'll describe some of the major challenges facing distributed marketing organizations, and I'll introduce a model that describes the components of an automated distributed marketing system. In the next two posts, I'll describe how the right technology tools can make distributed marketing more productive. The final post will discuss why distributed marketing concepts have become important for organizations that don't use a classic distributed marketing model.

Distributed Marketing Challenges

Organizations that use distributed marketing face the same marketing challenges as everyone else. They must manage communications across a growing number of marketing channels, create and deliver more relevant marketing messages and materials, and improve marketing productivity to maximize the return produced by every dollar invested in marketing.

These challenges are formidable enough on their own, but companies with a distributed marketing model also face challenges that organizations with centralized marketing operations don't typically encounter. In a recent study by the Aberdeen Group, survey participants were asked to identify their top two distributed marketing challenges. By a large margin the top two challenges were:

A Model for Distributed Marketing Automation

The good news is, technologies now exist that can enable companies to improve both the effectiveness and the efficiency of distributed marketing operations. As a practical matter, you simply can't maximize the productivity of distributed marketing without the right technology tools.

In the marketplace, these technologies can be called marketing asset management, distributed marketing automation, or local marketing automation. We'll refer to these technologies generically as distributed marketing solutions.

Distributed marketing solutions enable companies to:

This is the first of four posts about distributed marketing. In this post, I'll describe some of the major challenges facing distributed marketing organizations, and I'll introduce a model that describes the components of an automated distributed marketing system. In the next two posts, I'll describe how the right technology tools can make distributed marketing more productive. The final post will discuss why distributed marketing concepts have become important for organizations that don't use a classic distributed marketing model.

Distributed Marketing Challenges

Organizations that use distributed marketing face the same marketing challenges as everyone else. They must manage communications across a growing number of marketing channels, create and deliver more relevant marketing messages and materials, and improve marketing productivity to maximize the return produced by every dollar invested in marketing.

These challenges are formidable enough on their own, but companies with a distributed marketing model also face challenges that organizations with centralized marketing operations don't typically encounter. In a recent study by the Aberdeen Group, survey participants were asked to identify their top two distributed marketing challenges. By a large margin the top two challenges were:

- Maintaining the consistency of our brand (56% of respondents)

- Lack of marketing expertise at the local level (48% of respondents)

A Model for Distributed Marketing Automation

The good news is, technologies now exist that can enable companies to improve both the effectiveness and the efficiency of distributed marketing operations. As a practical matter, you simply can't maximize the productivity of distributed marketing without the right technology tools.

In the marketplace, these technologies can be called marketing asset management, distributed marketing automation, or local marketing automation. We'll refer to these technologies generically as distributed marketing solutions.

Distributed marketing solutions enable companies to:

- Streamline and automate the creation, procurement, customization, and distribution of marketing materials, including marketing collateral documents, promotional items, and point-of-sale materials

- Streamline and automate the creation, customization and execution of advertising and marketing programs by local marketers

As this diagram shows, a distributed marketing solution is built on a foundation that includes a sound distributed marketing strategy and a solid technology infrastructure. Distributed marketing solutions also contain two critical technology toolsets - marketing asset management and customer engagement management.

In my next post, I'll discuss the role of marketing asset management in a distributed marketing solution.

Read Part 2 of the series here.

Read Part 3 of the series here.

Read part 4 of the series here.

Sunday, October 7, 2012

Why BANT No Longer Works for Qualifying Leads

One of the most widely-used methods for qualifying B2B sales leads is known by the acronym BANT, which stands for Budget - Authority - Need - Timeline. The basic idea is that you will have a strong sales opportunity if you identify a lead who:

In reality, however, BANT is no longer an effective way to qualify sales leads for two reasons.

Budget

B2B companies no longer budget for many purchases in advance. Surveys by DemandGen Report indicate that only 20% - 30% of purchases are budgeted at the beginning of the year. Between 70% and 80% of survey respondents say they evaluate potential solutions, build a business case for immediate adoption, and then obtain spending approval. Therefore, if you require qualified leads to have established budgets, you will obviously miss out on many sales opportunities. Instead of requiring a specific budget, what you have to do is make a judgment call about whether a prospect has the financial ability to purchase your product or service.

Authority

In the 2012 Sales Performance Optimization survey by CSO Insights, 76% of respondents indicated that 3 or more individuals are involved in making the final buying decision. Purchasing by committee is now the norm. In this environment, most of the leads you encounter won't have full purchasing authority, but many of these leads will play a major role in the final buying decision. The right criteria for lead qualification is influence or involvement, not authority.

Need

Of the four BANT criteria, need is still obviously essential. In most cases, if there's no need, there won't be a sale. Even here, however, the idea of "need" is changing. In the past, the goal was to find a lead who recognized the need and understood it. Now we know that a seller can often have greater influence with a lead who does not fully understand the scope or implications of the need, at least at the beginning of the engagement. This can enable the seller to use marketing content and sales messaging to shape and influence how the lead thinks about the need and possible solutions.

Timeline

The primary problem with using timeline for lead qualification is that by the time a prospect has set a timeline for a significant purchase, the prospect has probably completed most of the buying process. In this sense, timelines have become like budgets. Potential buyers identify needs, evaluate potential solutions, and then get spending approval and set a purchase timeline. In fact, a purchase timeline may not be set until after the supplier has been selected.

For many years, BANT provided a useful framework for qualifying sales leads. Given the new realities of B2B buying, however, BANT no longer works for lead qualification. Today, the BANT criteria develop and evolve as the buying process moves forward. But, you can't expect them to exist at the beginning of a prospect relationship.

- Has a recognized need that your company can address

- Has the authority to make the buying decision

- Has the budget to purchase the kind of product or service you provide

- Has an identified timeline for purchasing the kind of product or service you provide

In reality, however, BANT is no longer an effective way to qualify sales leads for two reasons.

- Some of the criteria are all but impossible for an individual "lead" to meet. So, a strict use of the BANT criteria will cause you to ignore many valuable leads.

- By the time a lead is fully "BANT-qualified," it's probably too late. Your odds of concluding a sale on your terms are greatly diminished because a competitor has probably established a favored position.

Budget

B2B companies no longer budget for many purchases in advance. Surveys by DemandGen Report indicate that only 20% - 30% of purchases are budgeted at the beginning of the year. Between 70% and 80% of survey respondents say they evaluate potential solutions, build a business case for immediate adoption, and then obtain spending approval. Therefore, if you require qualified leads to have established budgets, you will obviously miss out on many sales opportunities. Instead of requiring a specific budget, what you have to do is make a judgment call about whether a prospect has the financial ability to purchase your product or service.

Authority

In the 2012 Sales Performance Optimization survey by CSO Insights, 76% of respondents indicated that 3 or more individuals are involved in making the final buying decision. Purchasing by committee is now the norm. In this environment, most of the leads you encounter won't have full purchasing authority, but many of these leads will play a major role in the final buying decision. The right criteria for lead qualification is influence or involvement, not authority.

Need

Of the four BANT criteria, need is still obviously essential. In most cases, if there's no need, there won't be a sale. Even here, however, the idea of "need" is changing. In the past, the goal was to find a lead who recognized the need and understood it. Now we know that a seller can often have greater influence with a lead who does not fully understand the scope or implications of the need, at least at the beginning of the engagement. This can enable the seller to use marketing content and sales messaging to shape and influence how the lead thinks about the need and possible solutions.

Timeline

The primary problem with using timeline for lead qualification is that by the time a prospect has set a timeline for a significant purchase, the prospect has probably completed most of the buying process. In this sense, timelines have become like budgets. Potential buyers identify needs, evaluate potential solutions, and then get spending approval and set a purchase timeline. In fact, a purchase timeline may not be set until after the supplier has been selected.

For many years, BANT provided a useful framework for qualifying sales leads. Given the new realities of B2B buying, however, BANT no longer works for lead qualification. Today, the BANT criteria develop and evolve as the buying process moves forward. But, you can't expect them to exist at the beginning of a prospect relationship.

Sunday, September 30, 2012

Who is Responsible for "Challenger" Lead Generation?

The principles described in The Challenger Sale continue to provoke a great deal of discussion among B2B marketing and sales professionals. In this important book, Matthew Dixon and Brent Adamson argue that what business buyers really want from their potential vendors - and by extension their sales reps - are fresh insights about how to improve their business. Dixon and Adamson are affiliated with the Corporate Executive Board, and CEB has make challenger selling a focal point of its sales advisory practice.

I've written about The Challenger Sale in previous posts (here, and here, for example), so I won't go into detail again. Essentially, Dixon and Adamson contend that high-performing sales reps challenge the thinking of prospective customers, make the costs of the status quo visible, and teach prospects how to think about problems and opportunities in new ways.

Earlier this month, Matthew Dixon and Nick Toman wrote a post for The Sales Challenger blog in response to some critics who have contended that challenger selling confuses the roles of sales and marketing. These critics say that communicating insights about new capabilities and benefits is the primary job of marketing.

Dixon and Toman point to new CEB research regarding how sales reps are engaging potential customers. According to this research, average salespeople:

Dixon and Toman don't appear to believe that sales reps should be completely responsible for lead generation. They point out that the heart of challenger selling is disruptive insights, and they acknowledge that depending on salespeople alone to develop such insights is a "fool's errand." According to the authors, it's marketing's responsibility to "arm" sales reps with the required disruptive insights.

So in a sense, Dixon and Toman are contending that marketing is responsible for identifying and developing the insights, but that sale reps are the primary channel for delivering those insights to potential customers.

With all respect, I disagree.

The reality today, whether we like it or not, is that business buyers are self-educating and avoiding conversations with salespeople until late in the buying process. Other research by CEB has found that the buying process is nearly 60% complete when prospects engage with suppliers, and I've seen similar results from research conducted by SiriusDecisions and others.

As powerful as challenger selling techniques are, they can't be effective if prospects won't talk or meet with you.

More than ever before, effective B2B demand generation requires the combined efforts of both marketing and sales. The real essence of the challenger message is that selling organizations must provide new and valuable insights to potential customers. In today's environment, both sales reps and marketers need to be armed with those insights, and they both must be involved in communicating those insights to potential buyers.

I've written about The Challenger Sale in previous posts (here, and here, for example), so I won't go into detail again. Essentially, Dixon and Adamson contend that high-performing sales reps challenge the thinking of prospective customers, make the costs of the status quo visible, and teach prospects how to think about problems and opportunities in new ways.

Earlier this month, Matthew Dixon and Nick Toman wrote a post for The Sales Challenger blog in response to some critics who have contended that challenger selling confuses the roles of sales and marketing. These critics say that communicating insights about new capabilities and benefits is the primary job of marketing.

Dixon and Toman point to new CEB research regarding how sales reps are engaging potential customers. According to this research, average salespeople:

- Believe lead generation is the company's responsibility

- Assess opportunities based on the clarity of customer needs

- Use social media indiscriminately

- Conduct non-traditional due diligence

- Personally own lead generation

- Lead with insights

- Use social media as a channel to deliver insight

Dixon and Toman don't appear to believe that sales reps should be completely responsible for lead generation. They point out that the heart of challenger selling is disruptive insights, and they acknowledge that depending on salespeople alone to develop such insights is a "fool's errand." According to the authors, it's marketing's responsibility to "arm" sales reps with the required disruptive insights.

So in a sense, Dixon and Toman are contending that marketing is responsible for identifying and developing the insights, but that sale reps are the primary channel for delivering those insights to potential customers.

With all respect, I disagree.

The reality today, whether we like it or not, is that business buyers are self-educating and avoiding conversations with salespeople until late in the buying process. Other research by CEB has found that the buying process is nearly 60% complete when prospects engage with suppliers, and I've seen similar results from research conducted by SiriusDecisions and others.

As powerful as challenger selling techniques are, they can't be effective if prospects won't talk or meet with you.

More than ever before, effective B2B demand generation requires the combined efforts of both marketing and sales. The real essence of the challenger message is that selling organizations must provide new and valuable insights to potential customers. In today's environment, both sales reps and marketers need to be armed with those insights, and they both must be involved in communicating those insights to potential buyers.

Sunday, September 23, 2012

Three Things To Do Before Hiring More Sales Reps

When B2B companies need to increase sales, managers will usually consider hiring more sales reps. This thinking is understandable because many B2B companies have long relied almost exclusively on their salespeople to find and win new business. Today, however, simply putting "more feet on the street" isn't likely to produce the volume of new sales that managers are looking for, and even if it does, the cost of those new sales is likely to be unacceptably high.

I've written before about why B2B companies should no longer rely exclusively on salespeople to generate new sales leads. Business buyers have fundamentally changed how they make buying decisions, and these changes require a new approach to B2B demand generation.

So, before you invest in more sales reps, there are three other steps you should take.

Step 1: Improve Lead Acquisition Marketing

If your marketing programs aren't producing at least 40% - 50% of your qualified sales leads, it's likely that you aren't investing enough in lead acquisition marketing or your marketing programs aren't as effective as they need to be. Marketing must play a larger role in generating new sales leads because in the current environment, business buyers are less receptive to traditional sales prospecting techniques, making such techniques far less effective and efficient.

For most B2B companies, effective lead acquisition marketing should include a mix of inbound and outbound marketing programs. In both cases, persistence is an important key to success. In today's environment, marketers must assume that multiple contacts will be required to entice a potential buyer to respond.