Earlier this year, eMarketer published a new estimate of the amount of time US adults (ages 18+) spend with various types of media. Like many media analysts, eMarketer estimates that the amount of time spent with mobile media is growing more rapidly than all other forms of media consumption, while the consumption of print media continues to decline precipitously.

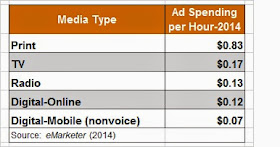

eMarketer also estimated the amount of advertising spending per hour of time spent with each type of media, and the table below contains some of the eMarketer estimates. As the table shows, eMarketer is projecting that this year, advertisers will spend 7 cents for every hour a US adult spends consuming mobile media, but more than 10 times that amount (83 cents) for every hour spent consuming print media (magazines and newspapers).

eMarketer isn't the only analyst to make this kind of consumption vs. spending comparison. In the 2013 edition of her widely-acclaimed annual presentation on Internet trends, Mary Meeker also compared the time spent consuming various types of media with advertising spending. The table below shows the data she presented, and her statistics also reveal significant disconnects between the time spent with print and mobile, and the amount of advertising spending devoted to those channels.

So, what's the point of these comparisons? The argument made by some is that advertising and marketing spending should reflect media consumption patterns. If you buy into this argument, then the above data would indicate that companies are over-investing in print advertising and under-investing in mobile advertising.

Understanding media consumption patterns is obviously important for effective marketing, but marketers shouldn't rely too much on high-level media consumption data for three reasons.

First, broad consumption patterns usually aren't specific enough to provide effective guidance for an individual company. As an enterprise marketer, what you really need to know is how the prospective buyers in your target market consume media. For example, Mary Meeker's data says that US adults spend only 6% of their total media consumption time on print media, but prospective buyers in your target market may spend considerably more of their time with print.

Second, the consumption data discussed above is restrictive. It only compares advertising spending to media consumption time. Numerous research studies have shown that spending on digital marketing has grown explosively over the past several years. Therefore, if the above data included all marketing spending, the comparisons would look substantially different.

Finally, the time people spend with a particular type of media isn't necessarily indicative of how effective that channel will be as a marketing tool. For example, many younger B2B buyers may spend a considerable amount of time using mobile devices for a variety of reasons, but that may not be the primary way they access business-related information. The fallacy is to assume that personal communications preferences and marketing communications preferences are identical.

The 2012 Channel Preferences Survey by ExactTarget found that personal communications habits are not a good indicator for marketers who are looking for the best way to communicate with potential buyers. As the authors of the survey report wrote, "The lesson here for marketers is that just because consumers embrace a channel for personal communications doesn't mean that they want to receive direct marketing messages from your brand via that channel." To improve the effectiveness of your marketing, you need to understand how your prospective buyers prefer to receive marketing messages.

The bottom line? Media consumption patterns are interesting, and they can be somewhat useful. But you need to know more to make sound marketing decisions.

The rules of B2B marketing are constantly changing. What worked yesterday won't necessarily work today. . .or tomorrow. This blog presents information, opinion, and speculation about where B2B marketing is headed.

Sunday, August 31, 2014

Sunday, August 24, 2014

Why Expert Content Should Be Part of Your Content Marketing Mix

About a year ago, I started to rethink my views regarding the role and value of third-party content in the marketing efforts of B2B companies. I had always believed that most of the marketing content used by a company should be developed internally or with the help of outside professional content developers. In either case, the "authorship" of the content is attributed to the company or to a company executive or internal subject matter expert. With third-party content, an external person or firm creates the content and is identified as the author.

My preference for "vendor-branded" content was based on the idea that a primary objective of content marketing is to communicate your company's expertise to potential buyers and thus cause those buyers to view your company as a trusted resource for valuable insights and as a capable business partner. Logically, branded content seemed to be the most direct way to accomplish this objective.

Because of three recent research studies, I now have a different view on this issue.

The 2013 Research

Last year, the CMO Council published a white paper - Better Lead Yield in the Content Marketing Field - that was based on a survey of more than 400 B2B content consumers. As the table below shows, survey respondents said they trust and value several kinds of third-party content more than vendor-created content.

The 2013 B2B Content Preferences Survey by DemandGen Report showed similar results. In this survey, B2B buyers were asked which of four types of content they give more credence to. The table below shows that vendor-branded content doesn't fare as well as third-party content.

The 2014 Research

The results of a third study published in March of this year provides even more compelling evidence regarding the effectiveness of "expert content." This research was commissioned by inPowered and conducted by The Nielsen Company. The Nielsen study involved 900 participants and consisted of a proctored, in-laboratory experiment combined with both a pre-experiment and a post-experiment survey.

During the in-laboratory portion of the study, participants were exposed to three types of marketing content pertaining to several types of products having a wide range of price points. Expert content included reviews and articles from third-party websites and blogs. User reviews were selected from the websites of major retailers or other online forums. Branded content consisted of content that was taken from the vendor's website.

The Nielsen study measured the impact of each type of content on three stages of the purchase decision-making process:

My preference for "vendor-branded" content was based on the idea that a primary objective of content marketing is to communicate your company's expertise to potential buyers and thus cause those buyers to view your company as a trusted resource for valuable insights and as a capable business partner. Logically, branded content seemed to be the most direct way to accomplish this objective.

Because of three recent research studies, I now have a different view on this issue.

The 2013 Research

Last year, the CMO Council published a white paper - Better Lead Yield in the Content Marketing Field - that was based on a survey of more than 400 B2B content consumers. As the table below shows, survey respondents said they trust and value several kinds of third-party content more than vendor-created content.

The 2013 B2B Content Preferences Survey by DemandGen Report showed similar results. In this survey, B2B buyers were asked which of four types of content they give more credence to. The table below shows that vendor-branded content doesn't fare as well as third-party content.

The 2014 Research

The results of a third study published in March of this year provides even more compelling evidence regarding the effectiveness of "expert content." This research was commissioned by inPowered and conducted by The Nielsen Company. The Nielsen study involved 900 participants and consisted of a proctored, in-laboratory experiment combined with both a pre-experiment and a post-experiment survey.

During the in-laboratory portion of the study, participants were exposed to three types of marketing content pertaining to several types of products having a wide range of price points. Expert content included reviews and articles from third-party websites and blogs. User reviews were selected from the websites of major retailers or other online forums. Branded content consisted of content that was taken from the vendor's website.

The Nielsen study measured the impact of each type of content on three stages of the purchase decision-making process:

- Familiarity with a new product

- Affinity toward a brand or product

- Purchase consideration of a brand or product

The results of the Nielsen study clearly demonstrate that expert content is the most effective type of marketing content in terms of impacting consumers across the entire purchase cycle. Expert content lifted familiarity 88% more than branded content, it lifted affinity 50% more than branded content, and it lifted purchase consideration 38% more than branded content. While the Nielsen study involved consumer products, it is likely that the results would be similar in a B2B setting.

It's clear from these research studies that potential buyers are inclined to trust third-party content (particularly expert content) more than content created by potential vendors, and B2B marketers should take advantage of this inclination. Content authored by a third-party expert and sponsored by your company can be a highly effective marketing tool. So, I'm now convinced that expert content should be an integral part of the content marketing mix at most B2B companies.

Sunday, August 17, 2014

How to Close the Performance Gap in Lead Generation and Content Marketing

Over the past few years, both lead generation and content marketing have become primary focus areas for B2B marketers. Because of changes in how B2B buyers are learning about business issues and possible solutions, marketers have been required to assume greater responsibility for acquiring and nurturing sales leads. Meanwhile, most B2B marketers now recognize that content marketing is the most effective way to create and maintain meaningful engagement with potential buyers.

Despite all of the recent focus on lead generation and content marketing, research indicates that companies vary significantly in terms of how well they are performing these critical marketing functions. Some companies excel at lead generation and content marketing, while others aren't doing nearly as well.

Last fall, the Content Marketing Institute and MarketingProfs published the results of their latest annual content marketing survey. In that survey, 93% of B2B respondents said they are using content marketing, but only 42% of respondents said their content marketing programs are effective.

Earlier this year, Demand Metric published the results of a lead generation benchmark survey. In that survey, 89% of respondents said their companies have a lead generation process, but only half of the respondents (49%) rated their lead generation efforts as moderately or highly effective.

The Demand Metric survey found that the three most widely used lead generation techniques were e-mail, tradeshow/event marketing, and content marketing. Demand Metric also found that the top three lead generation techniques were the same regardless of company size or whether a company was growing or experiencing declining revenues, and regardless of how respondents from the company rated the effectiveness of their lead generation process.

In other words, Demand Metric found that everyone is essentially using the same lead generation techniques, but some companies are achieving better results than others. The logical conclusion is that lead generation effectiveness is not a function of which techniques are used, but how those techniques are planned and executed.

So, what attributes and practices separate companies with high-performing lead generation and content marketing programs from those whose programs are less effective? The CMI/MarketingProfs research provides insights on this important issue.

CMI and MarketingProfs compared several attributes of highly-effective content marketers with less effective content marketers. Highly-effective content marketers were survey respondents who rated the effectiveness of their organization's use of content marketing as 4 or 5 (on a scale of 1 to 5, with 5 being "Very Effective"). Less effective marketers were those respondents who rated the effectiveness of their organization's use of content marketing as 1 or 2 (with 1 being "Not At All Effective"). The table below shows the results of this comparison.

As this table shows, companies with highly-effective content marketing programs are more likely to:

Despite all of the recent focus on lead generation and content marketing, research indicates that companies vary significantly in terms of how well they are performing these critical marketing functions. Some companies excel at lead generation and content marketing, while others aren't doing nearly as well.

Last fall, the Content Marketing Institute and MarketingProfs published the results of their latest annual content marketing survey. In that survey, 93% of B2B respondents said they are using content marketing, but only 42% of respondents said their content marketing programs are effective.

Earlier this year, Demand Metric published the results of a lead generation benchmark survey. In that survey, 89% of respondents said their companies have a lead generation process, but only half of the respondents (49%) rated their lead generation efforts as moderately or highly effective.

The Demand Metric survey found that the three most widely used lead generation techniques were e-mail, tradeshow/event marketing, and content marketing. Demand Metric also found that the top three lead generation techniques were the same regardless of company size or whether a company was growing or experiencing declining revenues, and regardless of how respondents from the company rated the effectiveness of their lead generation process.

In other words, Demand Metric found that everyone is essentially using the same lead generation techniques, but some companies are achieving better results than others. The logical conclusion is that lead generation effectiveness is not a function of which techniques are used, but how those techniques are planned and executed.

So, what attributes and practices separate companies with high-performing lead generation and content marketing programs from those whose programs are less effective? The CMI/MarketingProfs research provides insights on this important issue.

CMI and MarketingProfs compared several attributes of highly-effective content marketers with less effective content marketers. Highly-effective content marketers were survey respondents who rated the effectiveness of their organization's use of content marketing as 4 or 5 (on a scale of 1 to 5, with 5 being "Very Effective"). Less effective marketers were those respondents who rated the effectiveness of their organization's use of content marketing as 1 or 2 (with 1 being "Not At All Effective"). The table below shows the results of this comparison.

As this table shows, companies with highly-effective content marketing programs are more likely to:

- Have a documented content marketing strategy

- Have someone with specific responsibility for overseeing and managing the content marketing program

- Devote sufficient financial resources to their content marketing program

While the CMI/MarketingProfs survey dealt specifically with content marketing, these attributes are equally applicable to lead generation. To have a highly-effective lead generation program, you need a well-conceived and documented lead generation strategy, someone dedicated to managing your lead generation efforts, and sufficient financial resources to support an effective lead generation program.

Sunday, August 10, 2014

How Top Performing Channel Sellers Improve Channel Partner Marketing

Every day, thousands of companies sell their products and services through channel partners such as franchisees, independent agents, and value-added resellers. Not only are indirect channel sales a significant part of the overall economy, many companies rely on them for more than half of their total revenues.

Channel vendors face the same marketing challenges that confront all types of business enterprises, but they also face challenges that companies with centralized marketing operations don't typically encounter. For many channel vendors, the single biggest marketing challenge is that many of their partners simply don't have the time, resources, or expertise to run effective marketing programs.

To address this challenge, channel vendors have implemented a variety of marketing enablement programs. There are three types of marketing enablement programs in use today - financial incentive programs, self-service partner portals, and managed marketing services.

These three types of programs are not mutually exclusive. In fact, they are complementary components of an effective marketing enablement system. As the following diagram illustrates, companies with the best-performing channel marketing operations combine all three types of programs to equip their channel partners with the tools and resources they need to run successful marketing programs.

Each type of marketing enablement program provides specific capabilities that are critical for successful channel partner marketing, but none of these programs alone provides everything that is required for a high-performing marketing enablement system.

Financial Incentive Programs

For decades, channel vendors have used financial incentive programs to boost the marketing efforts of their channel partners. These programs have historically taken one of two forms - market development funds programs and co-op marketing (advertising) funds programs.

MDF and co-op programs are an essential component of any high-performing marketing enablement system because many channel partners don't have the financial resources to market effectively. However, MDF and co-op programs are not usually sufficient to significantly boost the marketing efforts of channel partners. The primary problem is that MDF and co-op programs are missing what many channel partners need most - help with planning, designing, and executing effective marketing programs.

Self-Service Partner Portals

For the past several years, channel vendors have been implementing a relatively new genre of web-based marketing automation technologies to simplify and streamline some marketing activities for channel partners. In the marketplace, several terms are used to describe these technologies, including distributed marketing automation, local marketing automation, partner relationship management, and marketing asset management.

The primary attribute of these technologies is a secure online portal site that enables vendors to manage marketing content resources and allows channel partners to perform a variety of marketing activities. These technologies provide powerful capabilities, but it's now also clear that they are not a complete solution for channel vendors or their partners. In fact, research has shown that fewer than 25% of channel partners use the partner portals provided by their channel vendors.

The main cause of the under-utilization is lack of time and expertise. Most partner portals are self-service solutions. They make it easier for channel partners to obtain marketing materials and customize those materials, but partners must still have the time and expertise to effectively use the materials that are available through the portal.

Managed Marketing Services

To increase the frequency and boost the effectiveness of their partners' marketing activities, a growing number of channel vendors are now adding managed marketing services to their marketing enablement systems. Managed marketing services typically include pre-packaged marketing campaigns, as well as campaign execution services. With managed marketing services, channel vendors give their partners access to a "marketplace" of complete, ready-to-execute marketing programs.

Managed marketing services make it easy for channel partners to run marketing campaigns. When partners want to run a particular campaign, they simply "order" it via an intuitive interface that mimics the shopping experience provided by consumer websites like Amazon.com. Once ordered, the channel vendor (or the vendor's marketing enablement solution partner) executes the campaign, making it completely turnkey for the channel partner.

--------------------

Effective marketing enablement is critical for driving increased revenues from indirect sales channels. Marketing enablement programs that combine financial incentives, web-based marketing technologies, and managed marketing services are the current state-of-the-art for improving the marketing efforts of sales channel partners.

Promotion Alert - An important part of my work is developing marketing content for companies that provide marketing enablement solutions to channel vendors. I have a new white paper that discusses the issues covered in this post, and it's now available for licensing. If you'd like to learn more about our content licensing program, or request a review copy of the new white paper, send an e-mail to ddodd(at)pointbalance(dot)com.

Channel vendors face the same marketing challenges that confront all types of business enterprises, but they also face challenges that companies with centralized marketing operations don't typically encounter. For many channel vendors, the single biggest marketing challenge is that many of their partners simply don't have the time, resources, or expertise to run effective marketing programs.

To address this challenge, channel vendors have implemented a variety of marketing enablement programs. There are three types of marketing enablement programs in use today - financial incentive programs, self-service partner portals, and managed marketing services.

These three types of programs are not mutually exclusive. In fact, they are complementary components of an effective marketing enablement system. As the following diagram illustrates, companies with the best-performing channel marketing operations combine all three types of programs to equip their channel partners with the tools and resources they need to run successful marketing programs.

Each type of marketing enablement program provides specific capabilities that are critical for successful channel partner marketing, but none of these programs alone provides everything that is required for a high-performing marketing enablement system.

Financial Incentive Programs

For decades, channel vendors have used financial incentive programs to boost the marketing efforts of their channel partners. These programs have historically taken one of two forms - market development funds programs and co-op marketing (advertising) funds programs.

MDF and co-op programs are an essential component of any high-performing marketing enablement system because many channel partners don't have the financial resources to market effectively. However, MDF and co-op programs are not usually sufficient to significantly boost the marketing efforts of channel partners. The primary problem is that MDF and co-op programs are missing what many channel partners need most - help with planning, designing, and executing effective marketing programs.

Self-Service Partner Portals

For the past several years, channel vendors have been implementing a relatively new genre of web-based marketing automation technologies to simplify and streamline some marketing activities for channel partners. In the marketplace, several terms are used to describe these technologies, including distributed marketing automation, local marketing automation, partner relationship management, and marketing asset management.

The primary attribute of these technologies is a secure online portal site that enables vendors to manage marketing content resources and allows channel partners to perform a variety of marketing activities. These technologies provide powerful capabilities, but it's now also clear that they are not a complete solution for channel vendors or their partners. In fact, research has shown that fewer than 25% of channel partners use the partner portals provided by their channel vendors.

The main cause of the under-utilization is lack of time and expertise. Most partner portals are self-service solutions. They make it easier for channel partners to obtain marketing materials and customize those materials, but partners must still have the time and expertise to effectively use the materials that are available through the portal.

Managed Marketing Services

To increase the frequency and boost the effectiveness of their partners' marketing activities, a growing number of channel vendors are now adding managed marketing services to their marketing enablement systems. Managed marketing services typically include pre-packaged marketing campaigns, as well as campaign execution services. With managed marketing services, channel vendors give their partners access to a "marketplace" of complete, ready-to-execute marketing programs.

Managed marketing services make it easy for channel partners to run marketing campaigns. When partners want to run a particular campaign, they simply "order" it via an intuitive interface that mimics the shopping experience provided by consumer websites like Amazon.com. Once ordered, the channel vendor (or the vendor's marketing enablement solution partner) executes the campaign, making it completely turnkey for the channel partner.

--------------------

Effective marketing enablement is critical for driving increased revenues from indirect sales channels. Marketing enablement programs that combine financial incentives, web-based marketing technologies, and managed marketing services are the current state-of-the-art for improving the marketing efforts of sales channel partners.

Promotion Alert - An important part of my work is developing marketing content for companies that provide marketing enablement solutions to channel vendors. I have a new white paper that discusses the issues covered in this post, and it's now available for licensing. If you'd like to learn more about our content licensing program, or request a review copy of the new white paper, send an e-mail to ddodd(at)pointbalance(dot)com.

Sunday, August 3, 2014

Does B2B Branding Still Matter?

Last year, I published a post here titled Why B2B Branding Still Matters. As the title of that post suggests, I argued that branding is still important for most B2B companies. In a book published earlier this year, Itamar Simonson and Emanuel Rosen provide a different and provocative take on the value of brands and brand building. Given the importance of this topic, I think it's worthwhile to look at both sides of the issue.

Brands Still Matter

Recent research by both CEB and McKinsey & Company provides strong evidence that branding remains critical to the success of B2B companies and that brand building is therefore still an essential marketing function.

In a 2013 study (From Promotion to Emotion), CEB looked at the impact of a strong brand on various buying behaviors. CEB compared the behavior of high brand connection customers - those who gave brands high scores for trust, image, and industry leadership - with the behavior of no brand connection customers. The CEB study found that high brand connection customers were:

Brands Still Matter

Recent research by both CEB and McKinsey & Company provides strong evidence that branding remains critical to the success of B2B companies and that brand building is therefore still an essential marketing function.

In a 2013 study (From Promotion to Emotion), CEB looked at the impact of a strong brand on various buying behaviors. CEB compared the behavior of high brand connection customers - those who gave brands high scores for trust, image, and industry leadership - with the behavior of no brand connection customers. The CEB study found that high brand connection customers were:

- 5 times more likely to give consideration to a brand

- 13 times more likely to purchase from a brand

- 30 times more likely to be willing to pay a premium for a brand's products or services

Research by McKinsey & Company has also found that strong brands create significant value for B2B enterprises. For example, B2B companies with strong brands generate a higher operating profit (EBIT) margin than other firms. McKinsey's research found that, in 2012, strong brands outperformed weak brands by 20%, up from 13% in 2011.

The McKinsey research also revealed that brand plays an important role in the purchase decisions of business buyers. In the US, for example, McKinsey found that the brand was responsible for 18% of the purchase decision, compared to 17% for the efforts of the sales team.

The Importance of Brands is Declining

In Absolute Value: What Really Influences Customers in the Age of (Nearly) Perfect Information, Itamar Simonson and Emanuel Rosen argue that technological innovations - aggregation tools, advanced search engines, online user reviews, social media, and easy access to expert opinions - are driving a fundamental shift in how consumers evaluate and purchase products and services. Simonson and Rosen contend that consumers used to make purchase decisions "relative" to other things, such as a brand name, their previous experience with a company, or a brand's advertising messages. In essence, potential buyers used brand reputation as a mechanism for estimating the value and satisfaction they would obtain from a product or service.

The authors contend that easy access to an abundance of more objective "third-party" information now makes it easier for potential buyers to know the "absolute value" of products or services, thus diminishing the importance and value of the brand.

My Take

The central argument made by Simonson and Rosen in Absolute Value is credible and persuasive. There is no doubt that information-based purchasing is becoming prevalent in more and more product categories. Consider, for example, the following data points:

- 70% of consumers surveyed by Nielsen in 2012 indicated that they trusted online reviews.

- 30% of US consumers begin their online purchase research at Amazon, which makes extensive use of user reviews. Essentially, Amazon has become a clearinghouse for product information.

- In 2011, research sponsored by Google found that the average shopper uses 10.4 sources of information in the purchase process, which was almost twice as many as in 2010.

Despite these facts, I contend that a strong brand is still critical to the success of most B2B companies and that brand building is still a critical B2B marketing function. A strong brand mitigates the perception of risk that accompanies significant investments and alleviates some of the fear that buyers inevitably experience when they're facing a major purchase decision.

The marketing techniques used for brand building have certainly changed. Encouraging, cultivating, and supporting positive third-party information is now clearly part of the brand building process. But, this doesn't mean that branding no longer matters.