Sunday, December 27, 2020

Our Most Popular Posts for 2020

Sunday, December 20, 2020

The Quest for Unified Marketing Measurement

Multiple research studies have shown that measuring marketing performance remains both a top priority and a major challenge for most marketers. For example, in Demand Gen Report's 2020 Marketing Measurement and Attribution Benchmark Survey, 82% of the respondents said that measuring marketing performance is a growing priority for their company, and 54% said their ability to measure marketing performance and impact needs improvement or is poor/inadequate.

Gartner's Marketing Data and Analytics Survey 2020 found that a majority of senior marketers (CMOs and VPs of marketing) are disappointed with the results they have received from their analytics investments. Fifty-four percent of senior marketing respondents said that marketing analytics had not had as much influence in their organization as they expected.

These research findings show that marketing performance measurement is still very much a work in process. Last year, Google published a white paper that addressed three of the most important - and still unsolved - challenges relating to the measurement of marketing effectiveness. I covered two of these challenges in previous posts (here and here). This post will discuss the third "grand challenge" described in the Google paper.

"Unified methods: a theory of everything"

At present, there are two main methods for measuring the effectiveness of marketing and advertising programs. Marketing mix modeling has been around for decades, and multi-touch attribution has now been used for several years. Each of these methods has strengths and limitations, and neither provides a comprehensive picture of marketing performance. As a result, the grand challenge for marketers is to develop a unified measurement method that will provide a holistic and accurate view of marketing effectiveness.

Marketing Mix Modeling (MMM) - MMM involves the use of statistical techniques to estimate the impact of marketing and advertising programs on incremental sales and/or other desired outcomes. These models are based on several months (or years) of historical data about sales and marketing/advertising spending across offline and digital channels. MMM also incorporates factors such as weather, competitive activity, seasonality, and overall economic conditions.

MMM is a top-down method that uses aggregate data; it doesn't evaluate the actions of individual prospects or customers. Because MMM is backward-looking and doesn't use individual-level data, it doesn't provide the timeliness or granularity that is needed to support tactical marketing decisions.

Multi-Touch Attribution (MTA) - MTA is a bottom-up method that is based on data about the actions and behaviors of individual prospects and customers. MTA solutions focus primarily on the financial impact of digital marketing programs. Therefore, they can overstate the amount of revenue attributable to digital marketing activities. MTA solutions can also be inaccurate because they usually don't account for a baseline of revenue that would exist without any marketing efforts.

Enter Unified Marketing Measurement (UMM)

Clearly, marketing leaders need (and want) a way to measure marketing effectiveness accurately and comprehensively. Since MMM and MTA use different types of data and measure different aspects of marketing effectiveness, one possible solution is to use both methods, and some companies have adopted this approach.

The Google white paper cited a 2018 survey conducted by ISBA (Incorporated Society of British Advertisers). In that survey, 29% of the respondents said they had fully integrated MMM and MTA. Another 39% of the respondents said they were using both MMM and MTA, but results are reviewed in silos.

During 2018, Google also conducted forty interviews with marketers at large brands in the UK about their marketing effectiveness practices. Here's how the Google authors described what they learned about the integration of MMM and MTA:

"While this wasn't a survey, examples of 'fully integrated' MMM and digital attribution were cited in fewer than a third of these conversations . . . When integration was mentioned, it was more the case that the advanced marketers now had effectiveness leaders whose role it was to understand marketing effectiveness as a whole, and consider results from different methods. These leaders were typically very aware of the pros and cons of MMM and digital attribution and were often blending insights from them, rather than integrating them at a technical level."

I suspect that little has changed since Google conducted these interviews, especially given the disruptive impact of COVID-19 this year.

Several companies are now offering technology solutions that purport to provide unified marketing measurement. In The Forrester Wave(TM): Marketing Measurement and Optimization Solutions, Q1 2020, Forrester evaluated nine "significant" vendors that offer some version of a UMM solution. The vendors included in the Forrester report were Analytic Partners, Ekimetrics, Gain Theory, Ipsos MMA, IRI, Marketing Evolution, Merkle, Neustar, and Nielsen.

The Issue of Accessibility

There's no doubt that we have made significant progress in measuring marketing effectiveness over the past several years. However, advanced marketing measurement solutions aren't cheap. In a 2018 report, Gartner estimated that companies pay from $100,000 to $250,000 on average for a one-year MMM or MTA solution. At this level of investment, these solutions aren't affordable for many small and mid-size companies

But notwithstanding the cost, advanced measurement solutions can be a smart investment for many companies. In a 2018 report, Forrester noted that such solutions will often enable a 15% improvement in marketing ROI, and that spending on marketing measurement represents only 0.2% of total marketing spending.

Image courtesy of Tatinauk via Flickr CC.

Sunday, December 13, 2020

Measuring the Long-Term Impact of Marketing

The conventional wisdom in the marketing community is that measuring the performance of marketing is now both necessary and achievable. And the conventional wisdom is accurate, at least in part.

The explosion of available data about customers and prospects and the expanding capabilities of marketing and analytics technologies have made some aspects of marketing easier than ever to measure. At the same time, however, measuring the impact of marketing on major business financial outcomes remains a difficult task.

Last year, Google published a white paper that discussed three of the most difficult challenges relating to the measurement of marketing effectiveness. The authors of the paper acknowledge that perfect solutions for these challenges don't currently exist. In fact, the primary objective of the paper was to focus on the areas where existing methods of measuring marketing effectiveness are "running up against the boundaries of the possible."

In my last post, I discussed the first challenge addressed by the Google authors - demonstrating a valid cause-and-effect relationship between a particular marketing activity and a particular business outcome. This post will cover the second "grand challenge" identified in the Google paper.

"Measuring the long term, today"

Some marketing programs are designed to produce results quickly, while others will have an impact over a longer period of time. According to some industry experts, many marketers have become too focused on the short term, to the detriment of overall marketing effectiveness.

Several recent research studies have confirmed that marketers are heavily focused on running short marketing programs and measuring short-term results. For example, in a 2020 survey of B2B marketers by The Marketing Practice (in association with Marketing Week), only 18% of the respondents said they run campaigns for more than six months, and only 20% said they measure the impact of campaigns beyond six months.

This survey was fielded about two months after COVID-19 economic lockdowns began, and the pandemic almost certainly affected the survey responses. But marketing "short termism" began long before COVID-19 reared its ugly head. The Google paper cited a 2018 survey of UK marketers by ISBA in which 61% of the respondents said they measure the impact of their marketing campaigns solely while the campaign is running or in the first three months after it ends. Only 13% said they measure impact for more than a year after a campaign ends.

A number of factors are driving this focus on short-term marketing results, but one of the most important is that long-term marketing effects are difficult to measure. And it's particularly difficult to measure the long-term financial impact of marketing. With marketing leaders under constant pressure to prove the value of their programs, it's not surprising they tend to favor marketing tactics that are easier to measure.

Despite the measurement difficulty, it's important that marketers and other senior business leaders understand the true value of longer term marketing programs. Research has shown that the highest level of marketing effectiveness is achieved when companies use both long-term ("brand building"} and short-term ("sales activation" or "demand generation") marketing programs.

What Marketers Need

The current state-of-the-art method for measuring long-term marketing impact is an enhanced version of marketing mix modeling. Unfortunately, this method requires several years of data, and the cost can be prohibitive for many companies. Equally important, this method, like all forms of marketing mix modeling, is backward looking, so it isn't that useful for marketers who need to make decisions in the present.

What marketers really need is a leading indicator - or a set of leading indicators - that can reliably predict longer-term business outcomes. Recently, share of search has emerged as a promising metric for this leading indicator role. Share of search can be defined as the volume of search queries for a specific brand as a proportion of all the search queries for all the brands that define a competitive category.

For example, suppose that there are five brands (A, B, C, D and E) in a particular product or service category and that over a given time period, a total of 100 searches were performed that included any of these brands. If brand A accounted for 35 of those searches, its share of search was 35% for that time period.

What makes share of search potentially valuable is that it is readily available on a real-time basis and it may be predictive of future outcomes like sales and market share. Recent research by Les Binet has shown that share of search can predict future market share in three categories - automobiles, energy (gas and electricity) and mobile phone handsets. Binet's research found that in these three categories, if a brand's share of search increases, its market share will rise over the following months. And conversely, when share of search declines, so does future market share.

Binet's research is very important, but it was also relatively narrow. It only involved three product categories. We will need more research to determine whether and to what extent share of search predicts future revenue growth and market share in other product and service categories. But if share of search does work in a wide range of categories, many marketers will have one of the key tools they need to make the measurement of long-term marketing effects straightforward, timely and affordable.

Image courtesy of Mike Lawrence (www.creditdebitpro.com) via Flickr CC.

Sunday, December 6, 2020

Google Highlights "Three Grand Challenges" in Marketing Performance Measurement

Measuring the performance and financial impact of marketing has been (and remains) a major challenge for marketing leaders. In the 2020 Marketing Measurement and Attribution Benchmark Survey by Demand Gen Report, 54% of surveyed marketers said their ability to measure marketing performance and impact needs improvement or is poor/inadequate. The comparable percentage was 58% in the 2019 edition of the survey and 54% in the 2018 survey.

Marketing leaders widely agree about why they need a better process for measuring marketing performance. Seventy-five percent of the respondents in the Demand Gen survey identified the need to show marketing's impact on pipeline and revenue, and 58% cited the need to show ROI from all marketing investments.

Over the past two-plus decades, technological advances have significantly improved our ability to measure some aspects of marketing performance. Today, for example, most forms of digital marketing are highly "trackable." We can know who has opened our emails and who has viewed our content. We can even know how much time was spent with our content.

But, measuring the financial impact of marketing remains particularly difficult because of several inherent characteristics of marketing. A recent article at the Harvard Business Review website captures some of the difficulties:

"Marketing's environment is typically much 'noisier' that the factory floor in terms of unknown, unpredictable, and uncontrollable factors confounding precise measurement. Marketing activities can also be subject to systems effects where the portfolio of marketing tactics work together to create an outcome . . . Marketing actions may also work over multiple time frames . . . Finally, it is often difficult to attribute financial outcomes solely to marketing, because businesses frequently take actions across functions that can drive results."

An Important Perspective from Google

Last year, Google published a white paper that addresses the vital topic of measuring marketing performance. The paper is appropriately titled "Three Grand Challenges" because the authors focus on three of the most gnarly challenges relating to the measurement of marketing effectiveness.

The three "grand challenges" described in the Google paper are:

- "Incrementality: proving cause and effect"

- "Measuring the long term, today"

- "Unified methods: a theory of everything"

- They must be carefully designed to eliminate extraneous factors that could impact the results.

- They can be expensive and difficult to administer.

- They typically can test only one or two activities at a time.

Sunday, November 29, 2020

What B2B Buyers Rely On to Make Purchase Decisions

Earlier this month, TrustRadius published the findings of its fifth annual B2B buying disconnect research. The 2021 B2B Buying Disconnect report is based on two surveys that were conducted in September of this year.

One was a survey of 907 individuals who are involved in making business technology purchases for their organization, and the second was a survey of 227 individuals who work for technology vendors in a sales or marketing capacity. More than 75% of the respondents in these surveys were based in the United States.

In my last post, I described some of the characteristics of the technology buying process identified by the TrustRadius research. In this post, I'll discuss what the TrustRadius study discovered about how technology buyers learn about products or services and research potential purchases. I'll also review where there are still disconnects between technology buyers and sellers.

It's important to note that the TrustRadius research focused exclusively on the attributes of technology sales and purchases and on the attitudes and behaviors of technology buyers and vendors. Therefore, the results of the TrustRadius surveys may not be completely applicable to all types of B2B purchases and sales. However, these research findings are relevant for those that involve high-consideration products or services.

Information Used to Inform Buying Decisions

A primary focus of the TrustRadius surveys has been to identify what sources of information technology buyers use to inform and support purchase decisions and which sources they view as trustworthy and influential. The latest survey found that buyers used an average of 6.9 sources of information when researching potential purchases, up from 5.1 sources in last year's survey.

The sources of information most widely used by technology buyers have not changed for the past five years, although their rank order has varied slightly. In the latest TrustRadius buyer survey, the five most frequently used sources of information were:

- Product demos (58% of buyer respondents)

- Vendor/product websites (51%)

- User reviews (45%)

- Vendor representatives (43%)

- Free trials/accounts (41%)

- Their own prior experience with the product (25% of buyer survey respondents)

- Recommendations from their network (15%)

- Online search for top products (15%)

Sunday, November 22, 2020

New Research Unveils the Attributes of B2B Technology Buying and Selling

Image Source: TrustRadius

This month, TrustRadius published the findings of its fifth annual B2B buying disconnect study. The 2021 B2B Buying Disconnect report provides a wealth of valuable insights regarding the sale and purchase of business technology solutions.

The report is based on two surveys that were fielded in September of this year. One was a survey of 907 individuals who were involved in making business technology purchases for their organization, and the second was a survey of 227 individuals who work for technology vendors in a sales or marketing capacity. More than 75% of the respondents in both surveys were based in the United States.

These surveys addressed a broad range of topics. The buyer survey includes findings about the technology buying process, how technology buyers learn about products and services and research potential purchases, and how they view technology vendors. The seller survey explored how technology vendors seek to engage potential buyers and how they rate the effectiveness of their marketing and sales tactics. And of course, both surveys addressed how the COVID-19 pandemic has impacted technology buying and selling in 2020.

The TrustRadius study focused exclusively on the attributes of technology sales and purchases and on the attitudes and behaviors of technology buyers and vendors. While the results of these surveys may not be completely applicable to all types of B2B purchases and sales, it's likely they would be similar to those involving complex, high-consideration products or services.

It will take a few posts to unpack the results of the TrustRadius research. In this post, I'll describe some of the basic attributes of technology buying and selling in 2020 and what we may see in 2021.

Technology Spending in 2020 and 2021

In the TrustRadius buyer survey, 49% of the respondents said their spending on technology products and services decreased in 2020, 27% reported increased spending, and 19% said their spending had not changed. It's noteworthy that only 21% of the buyer respondents expected their 2020 technology spending to decrease "substantially."

These responses reflect the uneven economic impacts of the pandemic. COVID-19 has severely affected companies in some industries (travel and hospitality, for example), while several other types of businesses have experienced dramatic revenue growth (think Amazon and Zoom).

TrustRadius found that the outlook for technology spending in 2021 is mixed. Fifty-six percent of the respondents in the buyer survey expect their technology spending to return to pre-pandemic levels or increase in 2021, while 17% expect spending to decrease next year, and 27% aren't sure what their technology spending will look like in 2021. More specifically, a majority of the buyer respondents expect to spend more on video and web conferencing software (64%) and online collaboration/project management software (53%) in 2021.

More Time Spent on Buying

TrustRadius also found that the pandemic has changed how much time buyer spend on technology purchases. In the buyer survey, about one-third of the respondents said they spent more time this year:

- Clearly defining the expected ROI of technology investments

- Researching products

- Comparing products

- Prioritizing selection criteria

Sunday, November 15, 2020

More Evidence on How B2B Marketers Have Responded to COVID-19

Image Source: Allocadia

Over the past six months, I've devoted several posts to reviewing research studies that have examined the impact of COVID-19 on B2B marketing and buying behaviors.

- The first series of posts (available here, here, and here) discussed the findings of a special edition of The CMO Survey that was fielded in May.

- In July, I published a post (Research Highlights How COVID-19 Has Changed B2B Buyer Behaviors) that described the results of an April survey conducted by Wunderman Thompson Commerce. The research focused primarily on the expanding role of e-commerce in B2B buying.

- Most recently, I published a post (Mid-Summer Research Updates COVID's Impact on B2B Marketing) discussing a June survey by Edelman and LinkedIn. This survey asked B2B marketers about how buying behaviors had changed and what actions they need to take to respond to those changes.

Sunday, November 8, 2020

Research Maps Spending on Content Marketing

Image Source: The Branded Content Project/Borrell Associates Inc.

Companies in the United States will spend $63.3 billion on content marketing this year, according to new research commissioned by The Branded Content Project. In 16 business categories, the use of content marketing is nearly ubiquitous, and it accounts for between 45% and 66% of the total marketing budget.

In mid-2020, The Branded Content Project engaged Borrell Associates Inc. to measure and analyze the economic landscape of content marketing. Sizing the Content Marketing Opportunity is based on a multi-faceted analysis of the business of content marketing. Borrell used data from its periodic surveys of small and mid-size businesses, SEC filings of public companies, and a variety of other data sources.

Content Marketing Spending

Borrell's analysis found that U.S. companies spent $64.3 billion on content marketing in 2019. Because of COVID-19, Borrell projects that content marketing spending will decline by 1.5% to $63.3 billion in 2020. This slight decline is almost entirely attributable to major spending cuts by companies that have been hit hard by the pandemic.

For example, Borrell found that companies in travel/tourism, live entertainment, sporting events, clothing and recreation have reduced spending on content marketing in 2020 by an average of 19%. Meanwhile, several other types of businesses - including financial services firms and real estate agents - have actually increased spending on content marketing this year.

The Growing Importance of Content Marketing

This analysis also found that content marketing is becoming a more important part of marketing for many companies. In Borrell's October survey of SMB's, 45% of the respondents said that content marketing had become more of a priority in 2020, and 57% said they are planning to increase content marketing in 2021.

Digital Dominates Content Marketing

It should not be surprising that most content marketing is conducted via digital channels. The following table depicts the top five media channels used for content marketing in 2020. As the table shows, digital media accounts for about two-thirds (66.3%) of all spending on content marketing this year, and collectively, these five channels account for 92.3% of all content marketing spending.

Borrell argues that digital channels dominate content marketing for two main reasons. First, digital channels can accommodate a wide variety of content formats (text, video, audio, etc.), and many types of digital content can be interactive, which makes them more engaging to potential buyers. More importantly, many digital channels enable companies to publish large volumes of content without incurring incremental advertising costs.

Business Category Rankings

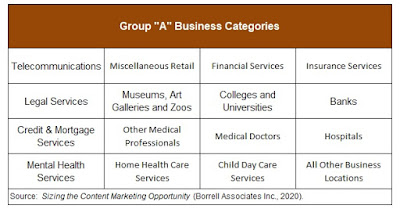

The Borrell report also provides detailed estimates for 100 distinct types of businesses. Borrell placed each type of business into one of six groups based on how likely that type of business is to engage in content marketing and what percentage of their marketing budget is devoted to content marketing. Borrell used the letters "A" through "F" to identify the six groups.

The 16 types of business organizations in group "A" (shown in the following table) are those that are most likely to be making extensive use of content marketing. In these businesses, the use of content marketing is nearly ubiquitous, and they spend between 45% and 66% of their marketing budgets on content marketing. These businesses are not necessarily the biggest spenders (on content marketing) in absolute terms, but they are devoting the highest percentage of their total marketing budgets to content marketing.

Organizations in group "B" aren't far behind. Borrell estimates that 75% to 85% of businesses in group "B" are using content marketing, and they are spending 40% to 60% of their marketing budgets on content marketing. Group "B" includes general merchandise stores (think Walmart, Target, etc.) and several types of media companies.

Two Caveats

It's important to make two points about the methodology used for this analysis. First, Borrell used an expansive definition of "content marketing." The report states:

"For this report, we considered Content Marketing to be the over-arching term that encompasses all facets of marketing - with content. This could be advertorials, native advertising, testimonials, many kinds of sponsorships, many kinds of branding, and any advertising that delivers some amount [sic] content besides a direct call to action."

This definition encompasses some marketing activities that many practitioners would not classify as "content marketing." So Borrell's spending estimates may be somewhat elevated.

On the other hand, Borrell's analysis did not include the internal costs that businesses incur to create and distribute content. Other research has shown that most companies are using internal resources to produce a significant about of marketing content. Therefore, Borrell's estimates probably understate the amount of spending actually devoted to content marketing.

Despite these caveats, Borrell's analysis makes an important contribution to our body of knowledge about content marketing.

Sunday, November 1, 2020

Gartner Research Maps the Landscape of Marketing Operations

Gartner recently published the findings of the 2020 Gartner Marketing Operations and Organization Survey. The survey results are described in two reports - the 2020 Marketing Operations Survey report, and the Marketing Organization Survey 2020 report.

This year's survey was conducted in May and June, and produced 429 respondents in the United States, Canada, France, Germany and the United Kingdom. All respondents were required to be involved in decisions regarding marketing operations and/or the alignment of marketing budgets, resources and processes. The respondents came from a variety of industries, and 91% were with organizations having $1 billion or more in annual revenue.

Given the composition of this survey panel, the findings are most reflective of circumstances in large enterprises. However, many of the findings will also be useful for marketing leaders in mid-size companies.

Here's a brief overview of some of the more interesting survey findings. Unless otherwise indicated, these findings are described in the 2020 Marketing Operations Survey report.

Adoption of Marketing Operations

Forty-nine percent of the survey respondents said that at least one marketing team in their organization has a dedicated marketing operations leader. Frankly, I was somewhat surprised by this finding. I would have expected this percentage to be higher, given the composition of the survey panel.

Other research has indicated that marketing operations functions have been implemented by many large and mid-size companies. In fact, Gartner's 2019 Marketing Organizational Survey found that more than two-thirds of marketing organizations have a discrete marketing operations function. And in Gartner's 2020-2021 CMO Spend Survey, marketing leaders ranked marketing operations as their third most vital marketing capability, behind only brand strategy and marketing analytics.

Current Scope of Marketing Operations

The 2020 survey also revealed that the responsibilities assigned to the marketing operations function vary significantly across companies. Gartner presented the survey participants with a list of 12 marketing activities and asked which of these activities was currently led or managed by their marketing operations function. The following table shows the percentage of respondents who selected each activity.

As this table shows, companies are using their marketing operations function to manage a wide variety of activities, and no activity was selected by a majority of survey respondents. This finding should not be surprising, given that marketing operations is still a relatively young business function.

Gartner hypothesizes that marketing leaders often create a marketing operations function to address whatever operational issues are most pressing at that time. Therefore, Gartner contends that the marketing operations role resembles that of a "chief of staff" whose primary job is to support the CMO.

Marketing Operations is Expanding

Gartner's research also indicates that marketing leaders plan to expand the scope of their marketing operations function in the near future. Gartner presented the survey participants a list of 12 marketing activities - plus a "none of the above" choice - and asked which of these activities would become part of their marketing operations mandate within the next 12 to 24 months. The five most frequently selected activities were:

- Data sourcing, consolidation and management (29% of respondents)

- Performance management, benchmarking and analytics (29%)

- Strategic planning, alignment and oversight (28%)

- Marketing technology management (27%)

- Maintaining talent audits and capacity needs (26%)

Sunday, October 25, 2020

Understanding the "Non-Rational" Dimensions of B2B Buying

It's now clear that human decision making is usually a mix of rational and non-rational components. The recognition of this fact began to emerge in the 1950's when leading behavioral scientists started challenging the concept of human rationality that had dominated mainstream economics for decades. The work of these scientists laid the foundation for a new discipline that would later be called behavioral economics.

In 2008, two books - Predictably Irrational by Dan Ariely and Nudge by Richard Thaler and Cass Sunstein - raised public awareness of behavioral economics and put it on the radar screens of business and marketing leaders.

In reality, marketers have been using principles of the behavioral sciences for years, albeit largely unwittingly. As a 2010 article by McKinsey put it, "Long before behavioral economics had a name, marketers were using it."

A paper recently published by Google provides several fresh insights about how people make buying decisions. Decoding Decisions: Making Sense of the Messy Middle is based on research conducted by Google in association with The Behavioural Architects, a research and consulting firm that specializes in the application of behavioral science to marketing.

Based on this research, Google and The Behavioural Architects developed a new model of the consumer buying process, which I described in my last post. The research also tested the influence of six heuristics and cognitive biases on buying decisions.

Heuristics are cognitive shortcuts or "rules of thumb" that humans use to simplify decision making. The use of heuristics enable us to reduce the mental effort required to make decisions. Behavioral scientists generally agree that heuristics can work reasonably well most of the time. However, the use of heuristics will also sometimes result in cognitive biases, which are decisions that deviate from what pure logic would indicate is more desirable.

Google and The Behavioural Architects evaluated the impact of six heuristics and biases on consumer buying decisions. The researchers observed 310,000 simulated purchase scenarios across 31 product categories. Each purchase scenario involved 1,000 participants who were asked to research a product they were actually in the market for.

Two of the six heuristics/biases tested in this study are particularly important for B2B marketers.

Social Proof

The most powerful heuristic identified in this study was social proof, which can be defined as our tendency to rely on the opinions and actions of other people when we're faced with a decision that involves ambiguity or uncertainty. In this study, social proof had the largest or second-largest effect in 28 of the 31 product categories tested.

While the Google research focused on consumer decision making, we also see evidence of social proof in the B2B space. For example, in a 2019 survey of technology buyers by TrustRadius, 52% of the respondents said they consult user reviews in their buying process, and they rated the trustworthiness of user reviews, on average, at 3.21 on a 4-point scale. In the 2020 Content Preferences Study by Demand Gen Report, 49% of the survey respondents reported they are using review sites to source information.

Authority Bias

Authority bias is the tendency of humans to rely on the opinions of individuals or firms that are viewed as authorities on a given subject. Google and The Behavioural Architects found that the authority bias was impactful in consumer buying decisions, although not quite as impactful as social proof. The authority bias was particularly strong in circumstances where consumers were less familiar with the product being researched.

We also see the authority bias at work in the B2B space. In the TrustRadius survey, 29% of the respondents said they used third-party publications in their buying process, and 24% reported using analyst reports. In the Demand Gen Report study, survey respondents rated content authored by a third-party publication or analyst as the type of content they give greatest credence to when evaluating a prospective purchase.

The Other Heuristics/Biases

The other four heuristics/biases evaluated in the Google research were:

- Category heuristics - rules of thumb and enable us to make fast and satisfactory decisions within a given product or service category.

- Power of now - our tendency to prefer products or services that are immediately available.

- Scarcity bias - our tendency to act when we believe that the offer of a product or service is limited in terms or time, quantity, or access.

- Power of free - the special appeal of a price that is exactly zero. Other studies have shown that we tend to prefer the offer of a free product over the offer of an alternative product that is more valuable, but not free.

Sunday, October 18, 2020

Google Takes a Fresh Look at the Buying Process

Marketers have been striving to understand how people make buying decisions for decades. In fact, the earliest formal description of the buying process - Elmo Lewis' famous AIDA model - is now more than 100 years old. The effort to decode how people make buying decisions - and to identify what can influence those decisions - has been the marketing equivalent of the quest for the Holy Grail or the search for El Dorado.

A paper recently published by Google provides several fresh insights on this vital topic. Decoding Decisions: Making Sense of the Messy Middle is based on an extensive research project conducted by Google in association with The Behavioural Architects, a research and consulting firm that focuses on the application of behavioral science to marketing.

The objective of Google's research was to answer what is probably the most important and most perplexing question in marketing: How to people decide what they want to buy and who they want to buy it from? Much of the recent research about the "buyer's journey" has focused on the actions people take along the path to purchase and on what sources of information and communication channels they rely on. In contrast, the Google research focuses on the mental processes that people use when faced with a purchase decision.

Based on this research, Google and The Behavioural Architects created a new model of the buying process and identified several mental shortcuts (heuristics) that people use to help them make buying decisions. While this research focuses on consumer buying decisions, the buying process model works equally well for many B2B buying decisions, and some of the heuristics also apply to B2B.

I'll describe Google's model of the buying process in this post, and I'll discuss the heuristics in a future post.

The Google Buying Process Model

The diagram below shows the buying process model that emerged from the research by Google and The Behavioural Architects. This research involved the observation of 310,000 simulated purchase scenarios across 31 product categories. Individuals participating in the study were asked to research a product they were actually in the market for. All the product research was performed online.

The study revealed that between the event or events that trigger a buying process and an actual purchase, there is what Google calls the "messy middle." The researchers concluded that there are no "typical" purchase journeys, but they also found that most people do engage in two distinct mental processes that are key to understanding what happens in the messy middle.

- Exploration - This is an expansive group of activities during which people explore their options, learn about products or services, brands, and companies, and expand their consideration sets.

- Evaluation - This is an inherently reductive group of activities during which people evaluate their options and narrow down their choices.

Sunday, September 27, 2020

Mid-Summer Research Updates COVID's Impact on B2B Marketing

Image Source: Edelman and LinkedIn

A report recently published by Edelman and LinkedIn provides a useful update on COVID-19's impact on B2B marketing and customer engagement. The report was based on a survey of 394 U.S.-based B2B executives in customer-facing business functions, including marketing, sales, business development, and communications. Survey respondents represented a wide range of industries and company sizes.

This survey was fielded in June, which means that responses were obtained after the initial shock of the COVID-19 pandemic had subsided and some early signs of economic recovery had appeared. So, the results should reflect a more balanced view of business conditions than surveys conducted in March or April, at the height of the economic lockdowns.

Not surprisingly, the Edelman/LinkedIn survey found that COVID-19 was impacting customer buying behaviors in several ways.

- Seventy-two percent of the survey respondents said their customers were focused on conserving cash and weren't interested in buying non-essentials.

- Sixty-one percent said most customers were interested in purchasing familiar products with proven reliability rather than new or more innovative products.

- Seventy-three percent said customers were interested in buying, but were slower to evaluate and commit to specific purchases.

- Eighty-four percent of the respondents said they needed to strengthen their position as a trusted thought leader who could help customers solve immediate problems.

- Seventy-two percent believe it's important to increase their communications with customers about their expertise in helping customers protect or grow sales.

- Sixty-two percent believe it's important to improve their understanding of their customers' customers through new or intensified research or data gathering.

- Forty-six percent of the respondents said that marketing spending was being closely evaluated for its direct impact on sales.

- Fifty-five percent said they were shifting their marketing efforts to focus on existing product or service offerings with immediate appeal, while only 45% said they were focusing on developing new products or services.

Sunday, September 20, 2020

What Brand Marketing and Anchovies Have in Common

In Italian cooking, anchovies - those salty little fish that usually come in tins or jars - are often added to a variety of sauces and dishes. Many people - including me - don't particularly like anchovies, so I'm tempted to omit them when using a recipe that includes them.

Professional chefs know this is a mistake. Anchovies add an important flavor element even though, in many cases, you don't specifically taste them in the final dish. If you leave the anchovies out, you will notice that "something" is missing, but you usually can't identify what the "something" is.

Strong brands play a similar role in the recipe for revenue growth at B2B companies. A brand that is well known and well respected will enhance the effectiveness of demand generation programs and make it easier for sales reps to win deals. And because brand perceptions tend to "stick" with potential buyers for a long time, a strong brand can make a significant contribution to long-term revenue growth.

The benefits of a strong B2B brand - and of investing in marketing programs that are specifically designed to build the brand - have been demonstrated in numerous research studies conducted over many years.

The CEB Research

For example, a 2013 study by CEB (now part of Gartner) compared the behaviors of high brand consideration customers with those of no brand consideration customers. High brand consideration customers were those who gave brands high scores for trust, image, and industry leadership. CEB found that high brand consideration customers were:

- 5 times more likely to give consideration to a brand

- 13 times more likely to purchase from a brand

- 30 times more likely to be willing to pay a price premium

Sunday, September 13, 2020

The Promise and Perils of Focusing on "In-Market" Prospects

Intent data and predictive analytics have been hot topics in B2B marketing circles for the past few years. Simply put, intent data is information collected about the online activities of a person with the goal of using that data to identify or predict purchase intent. To make this prediction, intent data is processed using a software application with predictive analytics functionality.

Some providers of intent data and/or predictive analytics capabilities have been rather effusive in describing the benefits of their solutions. Consider, for example, these two blog post passages from firms operating in the intent data/predictive analytics space:

"To avoid wasting time and money pursuing prospects that either already just bought the product from your competitor or are not serious about buying yet, your team should focus on the right people, targeting them at the right time by leveraging intent data, which will help you understand total active demand. Instead of a broad market of generic buyer personas, it enables you to find specific accounts that are active in your market."

"The opportunity represented by intent data is obvious: find in-market buyers before they enter the funnel by tracking their online behavior and content consumption on different websites. Get enough of a head start and you can land a deal before they even consider your competition, shorten your sales cycle, and cut your customer acquisition costs."

This is heady stuff because the ability to know which prospects are engaged in an active buying process could enable fundamental changes in the practice of B2B marketing.

The Promise

For example, suppose that your company has implemented account-based marketing. With intent data and predictive analytics, you could select ABM target accounts based on both fit (how well a prospect matches your ideal customer profile) and interest (whether a prospect is "in-market"). You could also frequently update your list of target accounts so that you have a near real-time view of which accounts are engaged in an active buying process.

This sounds like marketing nirvana, right? When you know which of your prospects are in-market, you can focus your marketing programs on this "low-hanging fruit," which should result in higher conversion rates, increased marketing efficiency, and as the blog passage says, lower customer acquisition costs.

The Perils

It's clear that some companies can reap substantial benefits from using intent data and predictive analytics in their marketing efforts. But intent data still has some important limitations that marketers need to understand. Those limitations have been widely discussed in articles and blog posts. For example:

- What Is Intent Data & How Can You Use It?

- How to Assess the Relevancy of 3rd Party Intent Data

- Intent Data is Great. Except When it Isn't

Using intent data and predictive analytics to focus marketing efforts on in-market prospects also presents a broader hazard. If taken to the extreme, it can lead marketers to ignore prospects that don't make the in-market cut. This is dangerous because it disregards an important aspect of how business buyers make buying decisions.

The conventional view is that a B2B buying process begins when a company's leaders or managers recognize a need or a problem and decide to do something about it. These "buyers" then gather information about the need or problem, evaluate possible solutions, and may or may not decide to buy a product or service to address the need or problem. So our traditional view of B2B buying is that information gathering, learning, and evaluation all occur after an intentional buying process is underway.

But business decision makers rarely begin a buying process with a clean slate. Every day, they are forming impressions of companies, brands, and products from touch points like ads, content resources, news reports, and conversations with business colleagues and friends. When something triggers an intentional buying process, these accumulated impressions become pivotal because they shape the initial consideration set.

The initial consideration set contains those companies and/or solutions that business decision makers immediately think of when they're faced with the potential need to buy something. And being included in the initial consideration set really matters. Research by McKinsey in the B2C space has found that brands in the initial consideration set can be up to three times more likely to be purchased than brands that aren't in it.

I suspect the impact is slightly less in B2B, but being part of the initial consideration set is still important because it all but guarantees that your solution will be one of those evaluated in the formal buying process. And, you have to be invited to the party before you can be asked to dance.

The importance of being in the initial consideration set explains why it would be a mistake for most B2B companies to focus their marketing efforts exclusively on in-market prospects.

At any given moment in time, a large majority of your most attractive prospects - those with high potential value and good fit - will not be engaged in an active buying process and would not qualify as being "in-market." These attractive prospects may not be likely to buy in the near term, but that doesn't mean they are unlikely to buy in the longer term.

If you focus your marketing efforts solely on in-market prospects, you'll be abandoning the opportunity to influence the perceptions and preferences of high-value future buyers.

Image courtesy of Fertile Ground via Flickr CC.